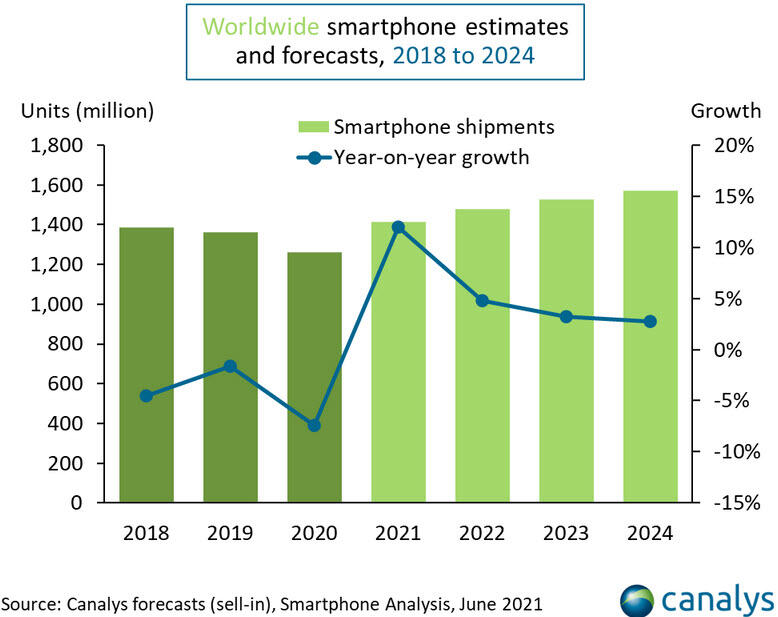

Smartphone shipments expected to recover by 12% over last year’s decline

Shipments are forecast to hit 1.4 billion in 2021, according to Canalys, though supply constraints, including the global chip shortage, threaten to limit growth.

Image: iStockphoto/Sitthiphong

The smartphone industry is poised to rebound in 2021 following last year’s market slump due to the coronavirus outbreak. In a report released Monday, research firm Canalys estimated that smartphone shipments would rise by 12% this year after a 7% drop in 2019. The positive trend has emerged in light of the global rollout of COVID-19 vaccines and ongoing efforts to subdue the pandemic.

SEE: Research: How 5G will transform business (TechRepublic Premium)

Calling the smartphone industry’s resilience “quite incredible,” Canalys research manager Ben Stanton said that people in certain parts of the world unable to spend money on holiday trips and similar activities have instead spent their disposable income on new smartphones.

5G phones have been a major beneficiary, snagging 37% of all shipments in the first quarter and likely to account for 43% (610 million units) for all of 2021.

Sales of 5G phones will be propelled by lower prices among different vendors, many of whom may water down key features such as display or power to include the latest cellular flavor in cheaper devices. By year’s end, 32% of all 5G devices shipped will have cost under $300, according to Stanton.

Image: Canalys

The one factor expected to limit smartphone shipment growth this year will be component bottlenecks. As shortages of microchips and other supplies hamper the tech industry, backorders continue to build, affecting every brand, Stanton said.

SEE: Edge computing adoption to increase through 2026; organizations cautious about adding 5G to the mix (TechRepublic Premium)

With the chip shortage, vendors will prioritize their allocation of smartphones by region, turning to lucrative developed markets such as China, the U.S. and Western Europe at the expense of Latin America and Africa, according to Stanton. But even in these more lucrative regions, shipments will be constrained. As a result, retailers will have to drive more sales through carriers and fewer through the open market. This chain of events may pave the way for more rival smartphone brands to gain sales in channels where the major players are unable to satisfy demand.

“The other angle to this is pricing,” Canalys VP of mobility Nicole Peng said in a press release. “As key components, such as chipsets and memory, increase in price, smartphone vendors must decide whether to absorb that cost or pass it on to consumers.”

Though the pandemic may be winding down in certain ways, its effects will continue to be felt across society and the smartphone market.

“Channels had to transform or die during the pandemic, and this forced innovation,” Stanton said. “Developed countries have seen an online surge, which has forced retailers to reassess their offline footprints. As a result, many stores will close this year, and for those that stay open, their purpose will be reimagined for customer support and order fulfillment, as customers increasingly use multiple channels during the purchase process.”

SEE: Electronic communication policy (TechRepublic Premium)

Fostered by COVID-19, certain innovations, such as product delivery to cars, have helped retailers move toward a more consolidated omnichannel approach. In this type of system, retailers try to deliver a more seamless and consistent experience whether the customer is buying through a desktop browser, a mobile device or a brick-and-mortar store.

“Centralized procurement will also give the channel more negotiating power with smartphone brands and may cause some retailers to attempt to bypass distribution to build new direct relationships,” Stanton said. “The new normal for the smartphone industry is as ruthless and competitive as the old one.”

Also see

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.