New report explains why TSMC favors Apple; Intel seeks to recapture process node leadership

Apple accounts for over 25% of TSMC’s revenue

The report notes that Apple accounts for 25.9% of TSMC’s business. Last year, the chip manufacturer took in $45.51 billion in revenue which means that Apple’s share of that business amounted to $11.4 billion. Second on the list is chip designer MediaTek and that firm was responsible for 5.8% of the foundry’s gross. No other TSMC client makes up over 5% of its revenue.

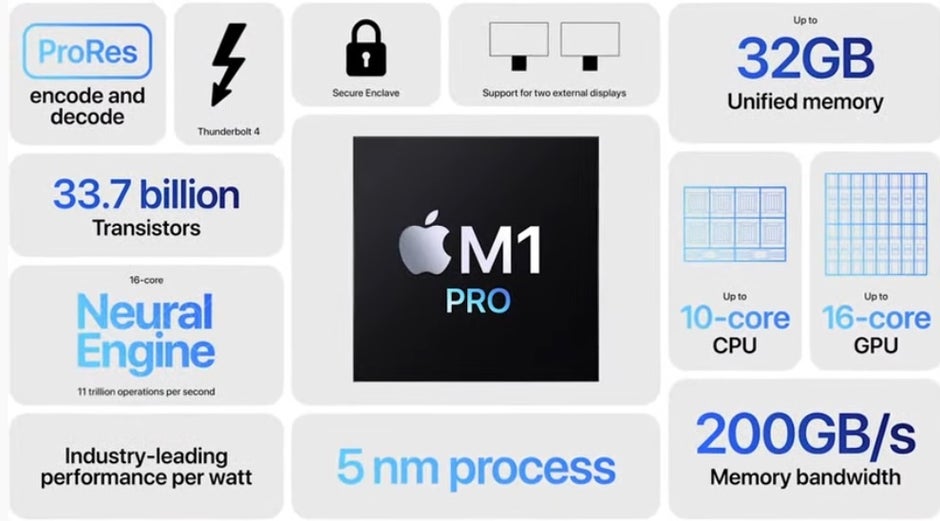

While in Taiwan, Intel brass is planning to meet with TSMC President Wei Zhejia and with other parts of Intel’s supply chain. Intel’s Gelsinger spoke with Axios on HBO and explained the push for obtaining 3nm capacity. “Apple decided they could do a better chip themselves than we could,” Gelsinger said.”And, you know, they did a pretty good job.”

Intel seeks to take back process leadership from TSMC and Samsung

Gelsinger added, “So what I have to do is create a better chip than they [Apple] can do themselves. I would hope to win back this piece of their business, as well as many other pieces of business, over time.” Intel also has announced plans to develop angstrom-scale chips and ramp up production of them in 2024. One angstrom (1A) is equivalent to .1nm and Intel is hoping that this innovation will make Intel the leading foundry able to produce chips carrying the highest number of transistors.

The big question for the industry is whether transistor size can continue to shrink allowing for more of them to fit inside a component as small as a chip. That is the key to the production of more powerful and energy-efficient chips. As for Intel, it is expected to be TSMC’s third-largest customer by 2023.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.