Musk still willing to buy Twitter under this one condition

Elon Musk believes that at least 10% of Twitter’s monetized daily average users are not real accounts

Musk believes that at least 10% of Twitter’s daily active users (DAU) that see ads are not authentic. Furthermore, Musk alleges in his countersuit that of the 229 million daily active users on Twitter, 65 million, or 28%, do not see any ads. To get a more accurate indication of the number of bogus accounts on Twitter, Musk used Botometer, a tool created by Indiana University that measures inauthentic accounts. With this tool, Elon’s team found more fake accounts than the number that Twitter disclosed, according to court filings.

Twitter and Musk square-off in court in October

With a trial set to begin in October, Musk’s lawyers wrote in a document submitted to the court, “Twitter was miscounting the number of false and spam accounts on its platform, as part of its scheme to mislead investors about the company’s prospects. Twitter’s disclosures have slowly unraveled, with Twitter frantically closing the gates on information in a desperate bid to prevent the Musk parties from uncovering its fraud.”

In his court filing, Musk claims that Twitter double counts linked accounts. The multi-billionaire claims that Twitter had inflated monetized daily active users in its SEC filings by as many as 1.9 million people each quarter.

Tinged with sarcasm, Twitter’s response was filed with the court and it said, “According to Musk, he — the billionaire founder of multiple companies, advised by Wall Street bankers and lawyers — was hoodwinked by Twitter into signing a $44 billion merger agreement.” Twitter added, “That story is as implausible and contrary to fact as it sounds.”

Bret Taylor, Twitter’s Chairman of the Board, said of Musk, “His claims are factually inaccurate, legally insufficient and commercially irrelevant.” And as far as the Botometer tool is concerned, Twitter called it unreliable and pointed out that it once called Mr. Musk’s own Twitter account “highly likely to be a bot.” In its lawsuit, Twitter said, “Musk refuses to honor his obligations to Twitter and its stockholders because the deal he signed no longer serves his personal interests.”

A clause in the contract could allow Musk to pay $1 billion to exit the deal if his financing falls through

A “specific performance” clause that is part of the contract allows Twitter to sue to get the deal to close as long as Musk’s financing remains in place. But if the funding for the deal falls through, Musk can pay $1 billion to end his obligations to buy Twitter.

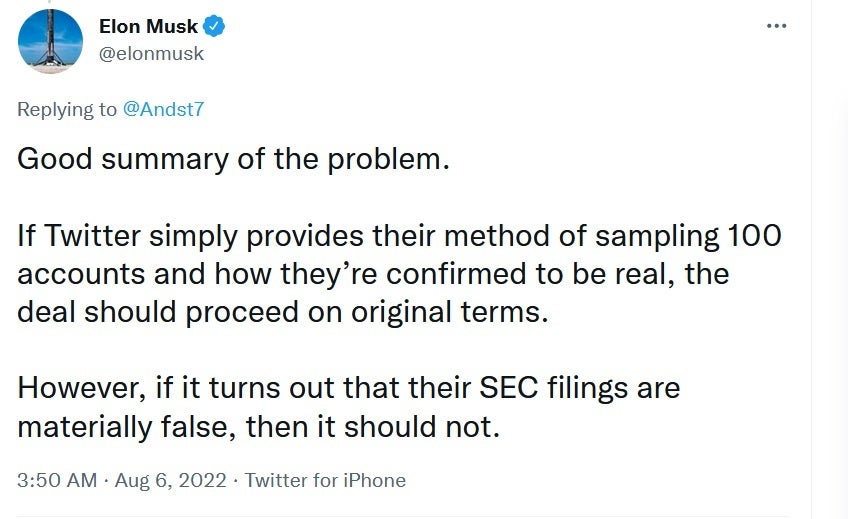

Tweet posted today by Musk gives some hope that the deal can be completed

While Musk is a multi-billionaire, much of his wealth is tied up in Tesla shares. Musk planned to borrow against the value of some of his Tesla shares to raise as much as $12.5 billion. A dangerous financial maneuver, had Tesla shares declined sharply, Musk could have been forced to pay additional funds with a margin call, or have the Tesla shares pledged as collateral for the loan sold out from under him.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.