Best free tax software 2022: Free filing options | ZDNet

Tax filings and payments are due by Monday, April 18, 2022. That day is quickly approaching, and tax preparation takes time and careful attention. Understanding the tools available to you is important, too.

Using a tax preparation service or a professional tax preparer is great if you can afford it. But many people are unaware that there are free tax software options available.

No matter how you file taxes, there is free tax software on the market that can help you get it done quickly and efficiently. Here is a look at some of the free tax software options that could help you during tax season.

Its goal is accuracy and max refund for tax filers

It may seem odd at first to list Credit Karma as one of the best free tax software since most folks associate them with free credit scores. But it is true: Credit Karma offers a free, online tax preparation program now called Cash App Taxes. To start, you must download the app.

Unlike other free tax filing software that may charge for state returns or certain deductions, Cash App claims there are no restrictions. You can file state or federal taxes for free regardless of the deductions or credits you choose.

Credit Karma/Cash App Taxes Advantages

-

High customer ratings: Nearly four million returns have been filed with an overall rating of 4.8 out of 5 stars.

-

Totally free: There are no hidden fees or restrictions, regardless of state or federal filing or the deductions and credits you choose.

-

Tax calculator: You can estimate your tax refund before downloading the app to file.

-

Faster refunds: Choose to receive your refund into Cash App to get it up to two days earlier.

-

Accurate: Cash App guarantees your tax filing is accurate and double-checks your return before submitting it.

- Maximum Refund Guarantee: You’ll receive the maximum refund you’re entitled to. Cash App will reimburse you up to $100 if you amended your tax refund with another service and received an additional refund.

Only for those with the simplest tax returns

TaxSlayer is not new to the tax filing game. Their paid versions are a top-notch option for tax filers with both simple and complex tax situations. But, if you are a simple tax filer, TaxSlayer’s free edition, TaxSlayer Simply Free, will work just as well as the paid version.

TaxSlayer Simply Free allows users to file federal income tax and state tax returns for free. However, the service is only offered to those with the simplest tax returns, such as W-2 income filers. If your tax situation meets the following the free service could be for you:

- You earn less than $100,000 in taxable income

- Have no dependents to claim

- File as Single or Married Filing Jointly

- Claim the standard deduction

- Can claim education credits

- Can deduct your student loan interest

Tax situations not covered would include:

- Earned Income Tax Credit

- Schedule A (itemized deductions)

- Schedule C (Self-employed) to name a few

- And more

TaxSlayer Simply Free advantages

- Simple e-filing: TaxSlayer Simply Free allows users to prepare and e-file basic 1040 returns with ease with guaranteed accuracy using a step-by-step instruction guide.

- Prior returns and support: TaxSlayer will import the data from a previous year’s tax return for free, even if it was with another tax preparation service — saving you time. They also offer unlimited email and phone support for users.

- Education expenses: You can claim education credits and even deduct student loan interest, helping you maximize your return.

Importing information and data is easy

H&R Block has been a trusted brand in tax preparation service for a long time and its free tax filing option is a popular choice among simple tax filers and first-time tax filers. The H&R Block help center is available to guide those through the process.

H&R Block offers free federal income tax and state tax returns and supports many of the common forms and schedules, such as Form 1040, Form 1098-T (tuition payment), and even Schedule EIC — Earned Income Credit. The free service is open to those in the following situations:

- Multiple W-2s

- Unemployment income

- S.S income (social security)

- Student Loan Interest (Form 1098-E)

- Those claiming children as dependents

Those who contribute to health savings accounts (HSAs), have itemized deductions, or are Schedule C (Self-employed) are not eligible for the free service and must upgrade to a paid tier of service.

H&R Block Free Online advantages

- Simple importing: Importing information and data is easy with the online version. Take a picture of your W-2 and upload it. Importing last year’s taxes is just as easy. You can use the mobile app to ensure those tasks get completed.

- Multiple income types: Those with retirement contributions, retirement income, and interest incomes are also qualified for the free service.

- Education deductions: H&R Block Free Online allows you to deduct student payments, tuition, and loan interest without having to upgrade to a paid tier.

Robust customer service and a guided, user-friendly tax filing solution

TurboTax is one of the top services for tax filing. Its free service brings the same expertise that has built a reputation in the industry. Those with W-2s and other simple tax returns will enjoy all it has to offer.

Free federal income tax and state tax returns are available and TurboTax Free Edition supports many of the important, commonly filed forms and schedules:

- US individual income tax return (1040)

- Unemployment income (1099-G)

- Schedule EIC (Earned income credit)

- Form 1099-INT (Interest income)

- Form 1040-V payment vouchers

Certain forms and schedules associated with more complicated returns, such as Schedule SE (Self-employed), Schedule D (Capital gains and losses), and educational forms, such as 1098-E and T (Student loan interest and tuition statement) require a paid tier.

TurboTax Free Edition advantages

- Maximize refund: If you get a larger refund using a different service, TurboTax Free Edition users are entitled to a payment of $30. If IRS penalties should arise from calculation errors, TurboTax will pay the penalty and interest. You will be shown if you qualify for additional credits, to help get you a larger return.

- Teaching tools: You will see your updated tax refund in real-time as you work through the process, and personalized insights will explain why you are receiving certain credits, helping you better understand your taxes.

- Support and security: TurboTax Free Edition offers some of the most robust customer services of all the free tax software programs available, and it’s one of the most secure cloud services.

Free federal and select state tax returns for individuals on a strict budget

TaxACT offers free federal tax filing for a wide range of individuals such as filers claiming dependents, unemployment income, college expenses, or retirement income. It’s one of the services approved for free tax filing by the IRS. To qualify for the service, you’ll need to be 56 years old or younger with an adjusted gross income of less than $65,000, or military personnel with an income under $73,000.

In addition to complementary federal filing, TaxACT provides free state tax returns for: AR, AZ, GA, IA, ID, IN, KY, MA, MI, MN, MO, MS, MT, NC, ND, NH, NY, OR, RI, SC, VA, VT, and WV.

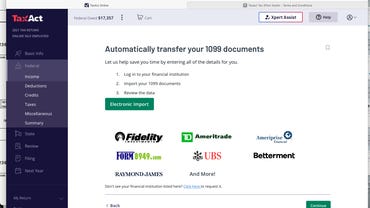

Using TaxACT is fairly simple. You can manually import your information or import PDF files from other services such as H&R Block or TurboTax. There’s a glossary with over 300 terms in addition to TaxAct Alerts that ensure accuracy to help you avoid an audit. TaxACT guarantees your return is correct for up to $100,000. And although it’s free, you can access your returns for up to seven years.

TaxACT Free Edition Advantages

-

Free state and federal tax returns: Besides the federal income tax filing, you can file state taxes for free for 23 states.

-

Guided filing: Follow the platform’s step-by-step process to ensure accuracy and make sure you didn’t miss a deduction.

-

Free mobile filing: You can also file for free using the TaxACT Express mobile app for your Android or iOS smartphone or tablet.

How do you file taxes?

There are really only three options when it comes to filing taxes:

- Manual filing: Manual tax filing is cut and dry. It is done by completing the IRS’s Form 1040, known as the Individual Tax Return form. Once it is completed, it is mailed to the IRS. However, paper tax returns are the slowest to process. The IRS had a backlog of nearly 3 million amended tax returns and a processing time of 20 weeks in the fourth quarter of 2021.

- Using a tax preparation service or tax professional: There are numerous tax preparation services and tax professionals to aid you in your quest during tax season. Some individuals opt for professional services to help them wade through the sea of forms and tax jargon — tax credits and deductions.

- Using tax software programs: Tax software programs are a popular option as well. Many online programs are offered to help walk people through the process of filing their taxes electronically. Of course, many of these software programs come with a cost but it may be well worth the small investment to receive your tax refund faster. Plus, most tax software programs come with fail-safe checks that ensure accuracy and maximize your deductions.

Can you file with the IRS for free?

The IRS offers free filing depending on your income amount. Incomes below $72,000 are eligible for free federal tax filing with an IRS partner site.

How to prepare for tax season

You can file your tax return as early as January 24 this year. The sooner you file, the sooner you can receive your refund (if you’re due one). Numerous tax preparation services and professional tax preparers stand ready to help during this tax season. Of course, these services often come with a fee depending on the tax situation. Complicated tax filers dealing with less common forms and schedules will benefit the most from professional services.

The new tax filing extension deadline is quickly approaching. For those with common, less complicated tax filings, such as W-2 employees, the process can be more simple and even free. Many of the top-tier tax preparation services offer free editions for simple tax filers who qualify, bringing their expertise at no cost to you.

Regardless of whether you file yourself using online tax software or a tax professional, you still have to do most of the legwork to get organized. You can make tax filing easier by getting organized in advance in a few ways:

-

Find and review the previous year’s tax return: Last year’s tax return can be a good starting point to determine what type of deductions you took and what figures and documents you may need to collect for the current year.

-

Save and categorize your receipts: If you plan on taking deductions for specific categories such as medical or work-related expenses, keep your receipts organized by categories such as uniforms, dry cleaning, prescription drugs, and more.

-

Download your tax forms: You could always wait to receive your 1099s in the mail or you can download them for free from the financial institution issuing them. Some of the most common 1099s you may receive are for your investments and for interest earned through your bank or credit union.

FAQs

Is free tax software really free?

Most tax services offer a limited free version for simple tax filings without too many credits or deductions. In many cases, the service only offers free federal taxes and state taxes have an additional fee. Freelancers or individuals with significant investments may also need to pay a fee for more complex tax filing.

What is the best free tax software?

Cash App Tax, formerly Credit Karma Tax, offers free tax filing for the widest range of situations, credits, and deductions.

Can I amend my tax return?

Most online tax software gives you the option to make changes to a tax return if you’ve missed something or filed incorrectly. You’ll need to log in to the platform and search for the option to amend the tax return. In some cases, you may need to reach out to customer service for help in filing an amended return.

How long does it take to get a tax refund?

The fastest way to get a tax refund is by filing online and selecting direct deposit as the refund method. The process will take less than three weeks and you won’t have to worry about the check getting lost in the mail. If you choose to mail in a tax return, a refund can take six to eight weeks after it’s received by the IRS.

ZDNet Recommends

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.