Commerce Depart report on the chip shortage names the major bottleneck holding things up

The U.S. Commerce Department has been investigating the global chip shortage and on Tuesday it released its report. So what caused companies as big as Apple to lose out on some revenue last year because they were unable to get their hands on certain chips? The report says that the factors involved all converged to create a “perfect storm” that made it difficult for manufacturers to obtain the chips needed.

The private sector is best equipped to handle the chip shortage says the report

The Commerce Department noted in its report that even going back before 2020, some semiconductor manufacturing equipment used to make older chips became hard to find. That also was the case for certain components used to build chips including diodes, capacitors, and substrates.

And as demand for 5G phones and base stations increased, and more consumers became interested in electric vehicles, more chips were needed. While demand was up, supply was down due to events that foundries could not plan for such as factory fires, energy shortages, shutdowns caused by COVID, and winter storms.

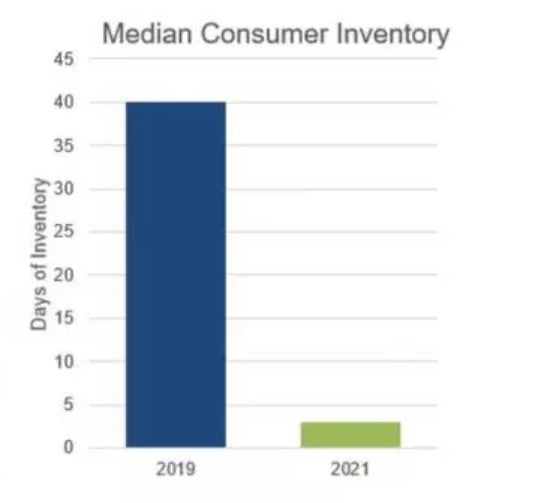

The administration has worked to improve transparency in the supply chain and has helped to create long-term partnerships that help ease the pain of dealing with a chip shortage that forced car manufacturers to lay off workers and at the same time, call for a halt in production. Still, no matter what semiconductor firms try, chip demand continues to outpace supply.

In September, the Department of Commerce sent Request for Information (RFI) solicitations to firms in the semiconductor supply chain in order to find out info directly from companies dealing with the chip shortage and the shortage of supplies. More than 150 responses came back including those from nearly every major semiconductor producer and from “companies in multiple consuming industries.”

The main bottleneck is the need for additional wafer production capacity

The Commerce Department notes that the RFI helped it find areas where bottlenecks led to supply and demand mismatches. In areas where these mismatches are extremely bad, the agency will dedicate resources to open up these bottlenecks. The main bottleneck across the board is wafer production capacity.

A wafer is a thin cut of semiconductor. Each wafer goes through a series of processes until wafer dicing cuts them into individual chips.

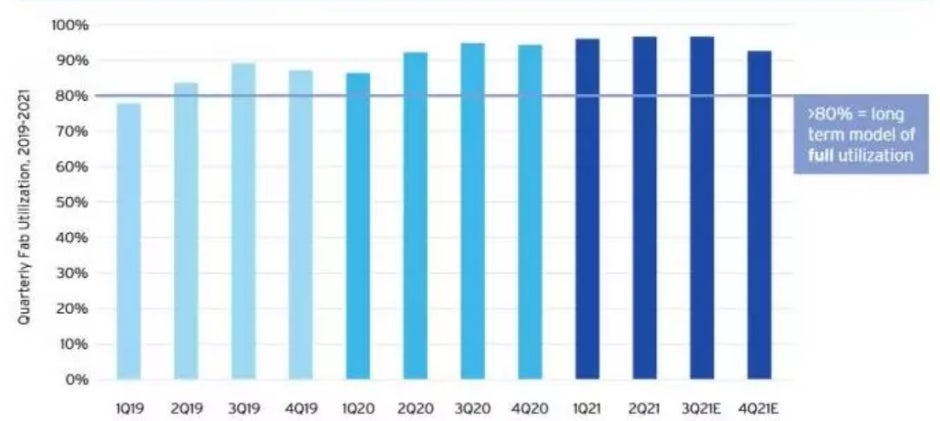

One of the interesting stats cited by the Commerce Department’s report notes that since the chip shortage started in 2020, the chip manufacturers have been running their fabs at a rate above 90% which the department says is “incredibly high” for a production facility that requires regular maintenance and high amounts of energy.

The kinds of chips impacted most by the shortage include:

- Microcontrollers that are primarily made of legacy logic chips, including, for example, at 40, 90, 150, 180, and 250 nm nodes.

- Analog chips including, for example, those produced at 40, 130, 160, 180, and 800 nm nodes.

- Optoelectronics chips including, for example, at 65, 110, and 180 nm nodes.

The bad news is that those in the industry who responded to the RFI do not see the chip shortage going away over the next six months. Additional fab capacity is needed, especially with foundries bumping up against 90% right now. Unfortunately, it takes years to design, build, and open a fab.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.