Cryptocurrency’s dirty secret: Energy consumption

Though skeptics may characterize cryptocurrency as “fake money,” “worse than tulip bulbs,” or outright fraud, it is a very real business. The market capitalization of the almost 19,000 cryptocurrencies in circulation is currently around $1.75 trillion—about the same as the gross domestic product of Italy, the world’s eighth largest economy. Even though you might not be able to buy a loaf of bread with Bitcoin at the corner store, many investors are putting a lot of legal tender money into cryptocurrencies.

But crypto has a dirty little secret that is very relevant to the real world: it uses a lot of energy. How much energy? Bitcoin, the world’s largest cryptocurrency, currently consumes an estimated 150 terawatt-hours of electricity annually—more than the entire country of Argentina, population 45 million. Producing that energy emits some 65 megatons of carbon dioxide into the atmosphere annually—comparable to the emissions of Greece—making crypto a significant contributor to global air pollution and climate change.

And crypto’s thirst for energy is growing as mining companies race to build larger facilities to cash in on the 21st century gold rush.

“Bitcoin mining operations are in an arms race between time, the volume of miners, and the efficiency of the machines they use,” said Joshua D. Rhodes of the Center on Global Energy Policy. “When it comes to Bitcoin’s energy use, it’s currently something of a ‘wildcatter’ market. The Texas grid operator ERCOT estimates that crypto miners may increase energy demand by up to 6 gigawatts by mid-2023, roughly the equivalent of adding another Houston to the grid.”

As Bitcoin mining increasingly comes under fire for its growing energy use, the phenomenon may be approaching a tipping point where, in order to prove to be a true game changer, crypto will need to come clean and go green.

The line goes up

Bitcoin enthusiasts, or miners, earn coins by using computers to solve puzzles in the decentralized database that underpins it, the blockchain. In the early days of Bitcoin, about a decade ago, miners could use home computers to mint new coins that were worth a few dollars, at least on a screen. As the market grew over time, the puzzles the miners had to solve to earn new coins grew more and more complex, requiring increased computing power and, by extension, energy.

Today, Bitcoin mining is a highly competitive business, with sprawling, climate-controlled facilities that house tens of thousands of high-tech computers operating around the clock. Though highly volatile, this year the value of a single Bitcoin has hovered around $40,000.

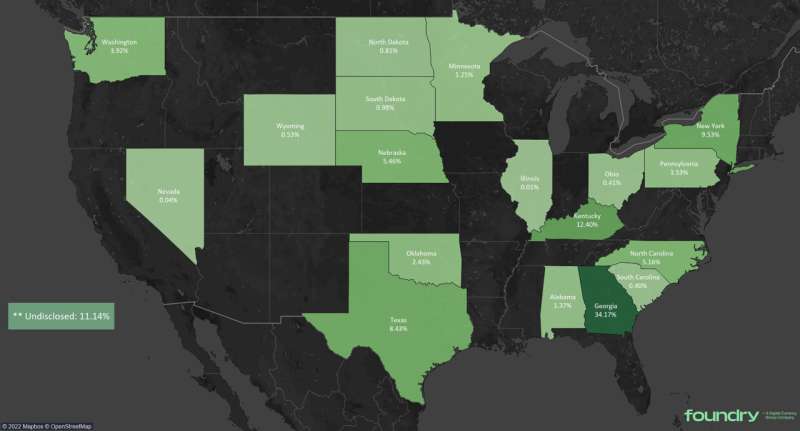

Like any evolving industry, cryptocurrency mining companies have sought to streamline their operations and maximize profits as they’ve scaled up. Finding cheap, plentiful energy is a key part of this strategy, and a deciding factor in where mining operations choose to set up shop. Until recently, about 75% of all Bitcoin mining took place in China, which offered access to both cheap electricity and hardware. But, citing concerns about fraud, economic instability, and meeting its climate goals, China’s government abruptly pulled the plug on decentralized digital currencies in 2021. Mining companies raced to find suitable locations with more lenient policies. Today, the lion’s share of Bitcoin mining takes place in the United States, where 35% of Bitcoin’s hashrate—the total computational power used to mine and process transactions—is now located.

Unfortunately, China’s crackdown on digital currencies appears to have made crypto mining even dirtier. Some mining operations in China had reduced their carbon emissions by taking advantage of cheap and abundant hydropower—a renewable energy source—during the rainy season. But after China’s crackdown, the share of natural gas used in Bitcoin’s electricity mix doubled to 31%. And Kazakhstan, now the world’s second largest Bitcoin hub, gets about 50% of its energy from high-emissions coal-powered plants.

Perhaps even more concerning, some companies in the U.S. are now bringing retired power plants back online in order to cash in on crypto. Greenidge Generation, a natural gas-powered Bitcoin mining plant in the picturesque Finger Lakes region of upstate New York, is a controversial example of this trend. Local groups point out that the plant not only pollutes the air, but also harms the Seneca Lake ecosystem by discharging up to 135 gallons of hot water a day into New York’s deepest glacial lake. More broadly, there are concerns the plant may be a canary in the crypto mine both for New York State and the nation.

Digital dollars and sense

Like other disruptive new technologies, cryptocurrency has caught governments unprepared and unsure how to regulate the explosive new market. Though Plattsburgh, NY, became the first U.S. city to temporarily ban cryptocurrency mining in 2018, currently there is no federal legislation that specifically focuses on crypto mining. However, despite opposition from the crypto industry, last week the New York State Assembly passed a bill that would impose a two-year moratorium on energy-intensive proof-of-work cryptocurrency mining facilities that receive behind-the-meter power from fossil fuel power plants.

“Such a moratorium is important because it would give New York the time to assess the environmental risks of the state’s expanding cryptocurrency mining industry, including the industry’s potential impacts on the state’s ability to meet the Climate Leadership and Community Protection Act’s greenhouse gas emission reduction targets, and to develop appropriate regulations in response,” said Jacob Bryce Elkin. Elkin is a fellow at the Sabin Center for Climate Change Law who authored a paper on the topic in March.

A corresponding bill currently awaits approval in the state Senate. However, the fate of the existing Greenidge plant remains unclear.

Greenidge Generation’s air quality permit expired last September, but the New York Department of Environmental Conservation has twice delayed making a decision on the renewal. During this time, Greenidge has raced to install thousands of new computers and dramatically increase its power generation capacity. Though it prohibits expansion, if passed in its current form the state’s moratorium would not apply to existing mining facilities. However, critics of the Greenidge plant, including DEC Commissioner Basil Seggos, have pointed out that it conflicts with New York’s landmark Climate Leadership and Community Protection Act, which calls for reducing economy-wide greenhouse gas emissions 40% by 2030. It’s been estimated that crypto mining could account for as much as 7% of all carbon emissions in New York State by the end of the decade.

The deadline for a decision on Greenidge’s permit has now been set to June 30—two days after statewide primary elections. In the meantime, Greenidge’s mining operations and expansion continue.

The future of cryptocurrency: Can gold go green?

Proponents of digital currencies and the blockchain point out that they are innovative technologies, and that we’ve only just begun to explore their potential.

“There are certain inefficiencies in our financial services industry that can be alleviated using blockchain technologies, enabling us to tackle important issues such as equity, access and costs,” said R.A. Farrokhnia, the executive director of Columbia’s Advanced Projects and Applied Research in Fintech. “With the right safeguards, oversight, and responsible deployments of innovation, we could couple advances in fintech and blockchain with ever-more sophisticated data analytics tools, in particular machine learning and AI, to create and offer robust products and solutions more efficiently, intelligently, ethically, and inclusively.”

Still, such promise may not be enough for skeptics—especially when it comes at such a high price. But crypto may have another opportunity to prove its value beyond its financial portfolio: by becoming a leader in the transition to sustainable energy sources.

“Some of my research has shown that, if the mines are willing to be flexible, they can pair well with renewables by quickly adjusting their energy use depending on current grid conditions,” said Rhodes. “However, it is not a given that they will do so. It is important for crypto mining to support the development of renewable (or other zero-carbon) energy because otherwise it will just be another industry contributing to the climate crisis.”

Like other industries, the cryptocurrency space will face many challenges if it attempts to go green, such as acknowledging its impact on the environment, integrating truly sustainable practices (such as the proof-of-stake consensus mechanism) into its operations, and ultimately eschewing the pursuit of profit at any cost.

If the crypto community is willing to meet these challenges it may yet prove itself to be truly transformative by harnessing both finance and technology to spur the transition to sustainable energy sources. If not, then perhaps the skeptics are right: when the Bitcoin bubble finally bursts, it may not only leave investors but the planet itself holding the bag.

Crypto miners’ electricity use in Texas would equal another Houston

This story is republished courtesy of Earth Institute, Columbia University http://blogs.ei.columbia.edu.

Citation:

Cryptocurrency’s dirty secret: Energy consumption (2022, May 5)

retrieved 5 May 2022

from https://techxplore.com/news/2022-05-cryptocurrency-dirty-secret-energy-consumption.html

This document is subject to copyright. Apart from any fair dealing for the purpose of private study or research, no

part may be reproduced without the written permission. The content is provided for information purposes only.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.