FreshBooks vs Wave: 2023 features comparison

Learn about the features of FreshBooks and Wave and compare which is better for your business in 2023. Discover which software is the most suitable for your accounting needs.

When your company requires accounting services, there are numerous options available. If you’re an enterprise business, you probably have an accounting department, staffed with the best and brightest. If you’re an SMB, you don’t always have that luxury and must turn to services and software solutions. If you’re a freelancer, maybe you just need a simple solution for keeping your numbers in line.

Fret not — there are services available that are great at helping you with your finances, many of which are more affordable than, say, QuickBooks. What are these options? Let’s take a look at two: FreshBooks and Wave.

Jump to:

What is FreshBooks?

FreshBooks is an invoicing and accounting software geared toward small businesses. With a focus on ease of use, FreshBooks offers solutions for freelancers, self-employed professionals, businesses that rely on contract work and standard businesses with employees.

FreshBooks originally began as a tool for managing invoices and eventually evolved into a full-blown accounting platform. Based in Toronto, FreshBooks services over 160 countries and is one of the easiest-to-use accounting platforms on the market. Even if you don’t speak fluent “accounting,” you’ll still be able to make use of the software.

In my personal experience, FreshBooks made me feel like I knew my way around numbers when in reality I always struggled with accounting. If FreshBooks can work for someone like me, it’ll appeal to business-minded persons.

What is Wave?

Wave calls itself “one-stop money management for small business owners” by providing financial services for small businesses. Wave simplifies the process of creating and sending invoices and helps you to stay organized ahead of tax season. Wave has an in-house team of bookkeeping, account and payroll coaches to help ease the burden when things get complicated.

Wave can help you with your invoices, payments, accounting, banking and payroll so you can stop chasing clients for money, get paid faster, track income and expenses, simplify your banking, pay your staff and get help when needed.

FreshBooks vs. Wave: Feature comparison table

| Freshbooks | Wave | |

|---|---|---|

| Invoicing and tracking | Yes | Yes |

| Sales tax and collection tracking | Yes | Yes |

| Track unpaid bills | Yes | Yes |

| Capture expense receipts | Yes | Yes |

| Reconcile bank accounts | Yes | Yes |

| Manage projects | Yes | No |

| Inventory tracking | No | No |

| Activity tracking | Yes | Yes |

| Track fixed assets | No | No |

| Phone support | Yes | No |

| Payroll integration | Gusto | Wave Payroll |

| ACH Payment processing | Yes | Yes |

| Accounting integration | Yes | Yes |

| Activity dashboard | Yes | Yes |

| Accounts receivable | Yes | Yes |

| Accounts payable | Yes | Yes |

FreshBooks features, pricing, pros and cons

Features

The features offered by FreshBooks depend on the plan you choose, of which there are four:

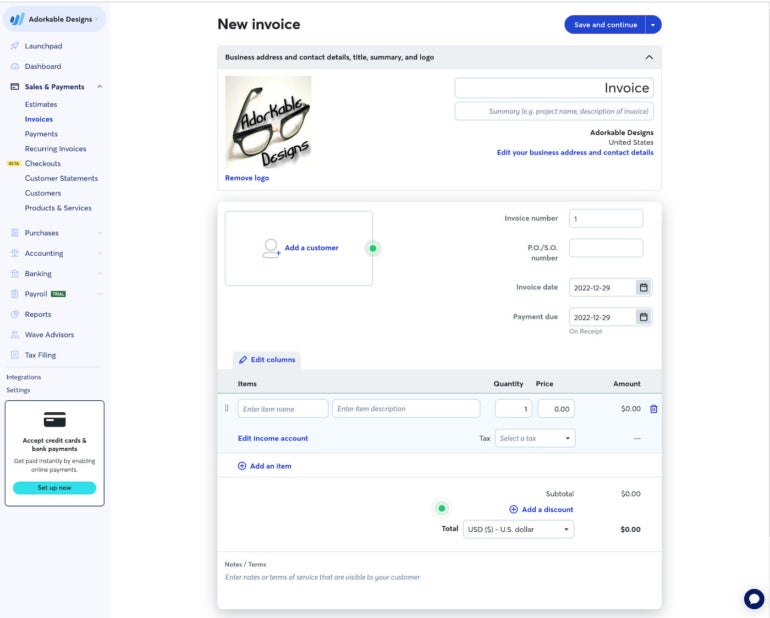

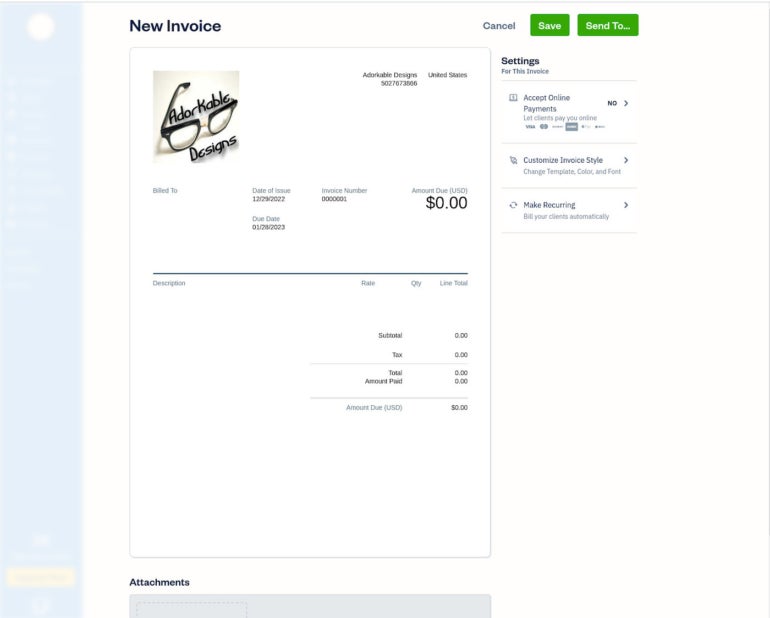

- Lite: Five billable clients, unlimited and customizable invoices (Figure A), unlimited expense entries, unlimited estimates, accepts credit card payments and ACH bank transfers, automated bank importing, unlimited time tracking, tax reports and sales tax tracking, and mobile mileage tracking.

- Plus: All features in Lite, plus 50 billable clients, automatic receipt scanning with the mobile app, double-entry accounting reports and business health reports, client retainers, accountant access and bank reconciliation tools.

- Premium: All features in Plus as well as unlimited billable clients, customized email templates and signatures, track project profitability and accounts payable tracking.

- Select: Everything in Premium plus access for two team members, a personal account manager, customized training and lower credit card transaction rates.

Figure A

Pricing

- Lite: $15 per month or $180 per year.

- Plus: $30 per month or $360 per year.

- Premium: $55 per month or $660 per year.

- Select: Contact FreshBooks for a quote.

Pros

- Simplified expense tracking.

- Detailed time tracking.

- Seamless project collaboration.

- Financial reports easy to generate.

- Mobile app makes it easy to work with financials on the go.

- Easy access to tax advisers and other accounting professionals.

- Half the price of QuickBooks.

Cons

- WePay integration means paying the higher processing rates of $0.30 per transaction plus 2.9% of the total.

- The mobile app doesn’t give you access to reports.

- Doesn’t work well for larger, more complex businesses.

- Few customization options.

- Costs extra to add additional team members.

Wave features, pricing, pros and cons

Features

- Unlimited tracking for income and expenses.

- Customizable sales tax.

- Unlimited bank and credit card integrations.

- Accounting reports and financial statements can be exported.

- Dashboard for at-a-glance cash balances and invoice statuses.

- Digital receipt upload and transaction management.

- Unlimited invoicing (Figure B).

- Payment reminders.

- Estimates can be converted to invoices upon approval.

- Online credit card payments (fees apply).

- Optional invoice and account syncing.

- Create and send invoices, then monitor their payment status via notifications.

Figure B

Pricing

Wave invoicing, account and banking features are free to use. There are, however, add-on services and transaction fees.

For the Payroll features, it’s a $40 per month fee plus $6 per active employee and/or $6 per independent contractor paid. You can also pay $149 per month for booking support and/or a one-time $379 fee for accounting and payroll coaching.

The Wave transaction fees are 2.9% + $0.60 USE per transaction, 3.4% + 0.60 per AMEX transaction, and 1% per bank payment transaction with a $1 USD minimum.

Pros

- Free service for basic accounting needs.

- Unlimited users and financial accounts.

- Highly customizable invoicing.

- Very user-friendly UI.

- Comprehensive online help center.

- The community forum allows you to get help from the Wave user community.

Cons

- Not scalable for larger businesses.

- No time tracking.

- Basic reporting options.

Which software to choose for your business

The choice between FreshBooks and Wave is simple. Wave is free for unlimited users, clients and accountant access. Although FreshBooks does have more advanced accounting features, you can get most of those same options with Wave and not pay a penny. The only drawback to Wave is that it scales less well than FreshBooks.

In the end, if you’re a small business or freelancer and don’t have the budget for an accounting or invoicing service, Wave is your best bet. However, if you plan to scale your company and don’t mind paying a bit more in fees, FreshBooks is what you want.

For more related content, check out FreshBooks vs QuickBooks, and the top invoicing apps for small businesses and self-employed individuals.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.