Google Tensor grabbed some AP chipset market share in 2021

We may earn a commission if you make a purchase from the links on this page.

Huawei still had some Kirin chipsets left in inventory

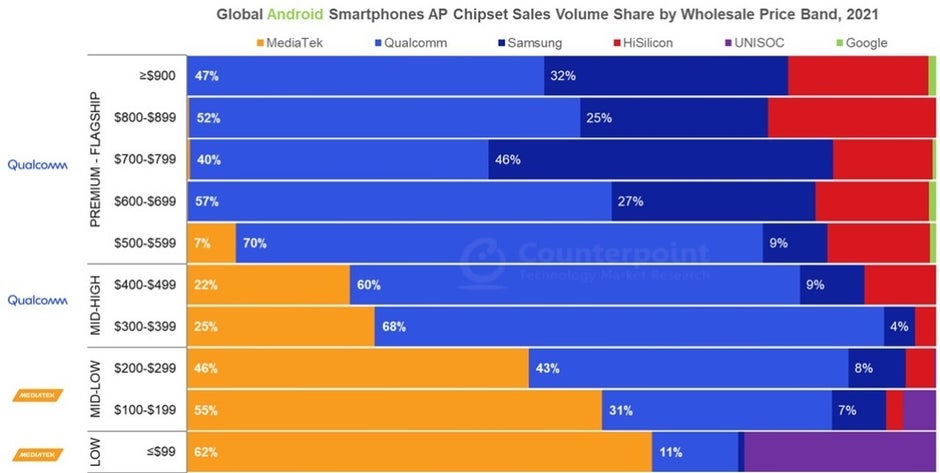

In the low-mid-range category, MediaTek and its Dimensity chipsets had the lead last year with Qualcomm second, Samsung third, Huawei fourth, and Unisoc fifth. For low-end handsets priced at $99 and less, MediaTek had the vast majority of the market with Qualcomm second, Samsung third, and Unisoc fourth.

Counterpoint says that to alleviate chip shortages in the future, Qualcomm could rely on dual-sourcing from both TSMC and Samsung. When it comes to its designs, the research firm says that “Qualcomm is generations ahead of its competition when it comes to premium experiences in a chipset, whether it is compute (CPU, DSP, GPU), AI (NPU), connectivity (4G, 5G sub-6GHz, 5G mmWave, Wi-Fi6/6E), security, or gaming capabilities.”

As expected, MediaTek dominated the low-end of the smartphone market

MediaTek is going after Qualcomm and Samsung’s flagship business with the Dimensity 9000. Most of the smartphone manufacturers in China such as OPPO, vivo, Xiaomi, and HONOR will release phones powered by the Dimensity 9000 this year. And Counterpoint says that MediaTek could end up supplying chips to as much as 10% of the premium Android market this year.

Pick up the Google Pixel 6 or Pixel 6 Pro

Samsung Mobile handed off the design and manufacturing chores for many of its high-mid-range handsets including models in the A, F, and M series. These third-party design firms mostly employed AP chips designed by Qualcomm, MediaTek, or Unisoc instead of using Samsung’s own Exynos chipsets.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.