IdentityIQ Secure Max review

IdentityIQ Secure Max: Specs

Frequency of credit scores: Monthly

Credit-improvement simulator: Yes

Address-change monitoring: Yes

Data breach alerts: Yes

Investment account monitoring: No

Medical records monitoring: No

Payday loan monitoring: No

Sex offender alert: No

Security software: Yes

Title-change alerts: No

Two-factor authentication: None

IdentityIQ Secure Max concentrates on credit monitoring, with monthly reports and scores from the top three credit-reporting agencies plus a valuable credit simulator.

Its identity-theft-protection includes the basics and then some, but it lacks several features now common among similar services, such as monitoring of investment accounts, medical records and property-title changes, or two-factor authentication.

However, since this review originally was published, IdentityIQ has partnered with antivirus maker Bitdefender to offer very good security software for just a couple of bucks more per month. IdentityIQ also ended the practice of sending ads to customers’ phones.

For pure identity protection, you’d be better off with IdentityForce UltraSecure + Credit, which offers many more features for less cost. Yet no other service offers monthly credit reports at IdentityIQ’s price.

Read on for the rest of our IdentityIQ review.

IdentityIQ: Costs and what’s covered

IdentityIQ lets you try its service out for a week for $1. It has four plans to choose among, starting with rudimentary identity monitoring and protection and escalating to a full credit monitor and identity shield.

The company doesn’t tack on sales tax when you sign up for a plan. If you pay yearly instead of month-by-month, you get a 15% discount.

The entry-level IdentityIQ Secure plan provides no credit reports, scores or simulator, but is a relative bargain at $7 a month or $71 per year. Adding Bitdefender Total Security adds $2 more per month. IdentityIQ Secure monitors your TransUnion credit file as well as your Social Security number and watches the “dark web” for any appearance of your personal information.

If your identity is stolen while your IdentityIQ subscription is in effect, the plan provides up to $1 million in insurance to cover stolen funds, the costs of hiring lawyers and experts to restore your identity and other expenses.

Jump to the IdentityIQ Secure Plus plan, which costs $10 a month or $102 per year, and you’ll get annual credit reports from all three bureaus (Equifax, Experian and TransUnion). The Bitdefender Total Security option adds $2 monthly or $21 yearly.

You also get annual VantageScore 3.0 credit scores based on those credit files, plus constant monitoring of your TransUnion credit file and notifications if someone tries to change your address. (VantageScore 3.0 scores only approximate the FICO credit scores that most lenders use to determine creditworthiness.)

At $20 a month ($204 per year), the IdentityIQ Secure Pro subscription provides constant three-bureau credit monitoring as well as credit reports and VantageScore 3.0 credit scores from all three bureaus every six months.

Secure Pro includes alerts about crimes committed in your name as well as notifications of changes in your credit scores. Adding Bitdefender costs another $2 per month or $21 per year.

IdentityIQ Secure Max raises the frequency of three-bureau credit reports and VantageScore 3.0 scores to monthly. It has a credit-score tracker as well as a credit-score simulator for trying out how different payment options might affect your scores.

The SecureMax plan adds $25,000 of extra theft-insurance coverage for family members and can help speed your recovery by acting on your behalf with a limited power of attorney. IdentityIQ Secure Max costs $30 a month or $306 per year. The Bitdefender option with this plan adds unlimited VPN service, and costs an extra $3 monthly or $31 yearly.

Even without the BItdefender option, IdentityIQ Secure Max is in the same price range as LifeLock’s top-line Ultimate Plus plan, and about $65 more than IdentityForce UltraSecure + Credit. Both of those provide credit reports and scores less frequently than IdentityIQ Secure Max, but offer more extensive identity-theft protection.

No matter which plan you choose, however, the Bitdefender offer is well worth considering. Bitdefender Total Security, one of the best antivirus programs, normally costs $90 per year for five devices, and the version with the unlimited VPN $150 per year. Getting either of them for $20 or $30 per year is a great bargain.

IdentityIQ is family-friendly. Any of its plans can protect up to three children for free until they’re 24 years old if they legally reside with their parents. Most other identity-theft-protection services charge extra per child or require separate family-plan subscriptions.

IdentityIQ got an A+ grade from the nonprofit Better Business Bureau, although it had a customer-review score of 2 stars out of 5. Most complaints concerned billing issues. The company has staff dedicated to respond to problems that surface on the BBB forum.

The for-profit website ConsumerAffairs.com gave IdentityIQ a 4.5 out of a possible 5 points. Like its rivals IdentityForce, Identity Guard and LifeLock, IdentityIQ is one of ConsumerAffairs.com’s “authorized partners” that pay the website for the chance to resolve complaints.

| IdentityIQ Secure | IdentityIQ Secure Plus | IdentityIQ Secure Pro | IdentityIQ Secure Max | |

| Monthly cost | $7 | $10 | $20 | $30 |

| Yearly cost | $71 | $102 | $204 | $306 |

| Family plan | Up to 3 kids covered for free | Up to 3 kids covered for free | Up to 3 kids covered for free | Up to 3 kids covered for free |

| Credit reports provided | None | Equifax, Experian, TransUnion | Equifax, Experian, TransUnion | Equifax, Experian, TransUnion |

| Credit bureaus monitored | TransUnion | TransUnion | Equifax, Experian, TransUnion | Equifax, Experian, TransUnion |

| Frequency of credit reports & scores | None | Yearly | Twice a year | Monthly |

| Type of credit score | None | VantageScore 3.0 | VantageScore 3.0 | VantageScore 3.0 |

| Credit-improvement simulator | No | No | No | Yes |

| Bank, card accounts monitored | Yes | Yes | Yes | Yes |

| Black-market (“dark web”) monitoring | Yes | Yes | Yes | Yes |

| Lost wallet assistance | Yes | Yes | Yes | Yes |

| Max. ID-theft coverage | $1 million | $1 million | $1 million | $1 million, plus $25K for family members |

IdentityIQ: How we tested

In the late summer of 2020, I signed up with the top plans of five of the biggest identity-theft-protection services, including IdentityIQ Secure Max. All subscriptions costs were paid for by me and later reimbursed by Tom’s Guide.

I used the services’ browser interfaces with my Lenovo ThinkPad T470 Windows laptop and Samsung Galaxy Note 20 Android phone. Over the course of three months, I logged in most days to check my credit scores, Secure Max’s alerts and notifications, and changes to my credit and identity scores.

I used the credit simulators and utilities and checked in with each company’s support staff at least once and recorded how long it took each to respond. At the end, I canceled all the service subscriptions.

IdentityIQ: Credit scores and monitoring

With IdentityIQ SecureMax, I not only had access to credit alerts and monitoring of my bank accounts, but monthly full credit reports from all three major credit bureaus. Few identity-theft-protection services provide this access to credit-file data.

IdentityIQ not only scans for your Social Security numbers, addresses and other personal identifiers on the open parts of the internet but on hidden “dark web” criminal marketplaces as well.

It keeps an eye on court records for signs of a bankruptcy proceeding, can tell you if an inactive account is being revived, notifies you if the U.S. Postal Service has received an address-change request in your name and can catch a new loan taken out in your name.

But IdentityIQ lacks dedicated tools to discover tax-return fraud, a payday loan in your name or attempts to change the name on the title of your home, three increasingly common modes of identity theft.

The flagship Secure Max service watches credit and debit card activity for suspicious actions, but it can’t monitor your investments or online payment services, such as PayPal, for potentially criminal behavior. It does have a unique Checking Account Report that alerts you to overdrafts as well as suspected debit-card abuse and fraud.

Unlike LifeLock and IdentityForce, IdentityIQ’s interface features no credit-freeze or credit-lock button to help you get started with locking down your credit files. IdentityIQ’s support people can nonetheless help you start a credit freeze.

IdentityIQ: Insurance and services

In the event your identity is stolen while you’re an IdentityIQ subscriber, the company’s U.S.-based support force can help limit the damage and start the process of recovering your good name and credit.

IdentityIQ offers a $1 million insurance policy underwritten by American International Group that can help cover the costs of getting your identity back.

The policy includes replacement of lost funds and reimbursement for expenses entailed in recovering your personal identity. It can also provide up to $7,500 for lost wages.

IdentityIQ: Notifications and alerts

By default, IdentityIQ’s alerts pop up on the browser interface. They are not available by SMS text messaging, which might delay action a little.

As far as balance of alerts goes, IdentityIQ was mixed. Over my three months subscribed to the service, I received six alerts. It caught my application for a new mortgage but also reported an employer change when none had occurred.

There was also an alert for a dark-web hit that might have been caused by me signing up for another identity-theft-protection service.

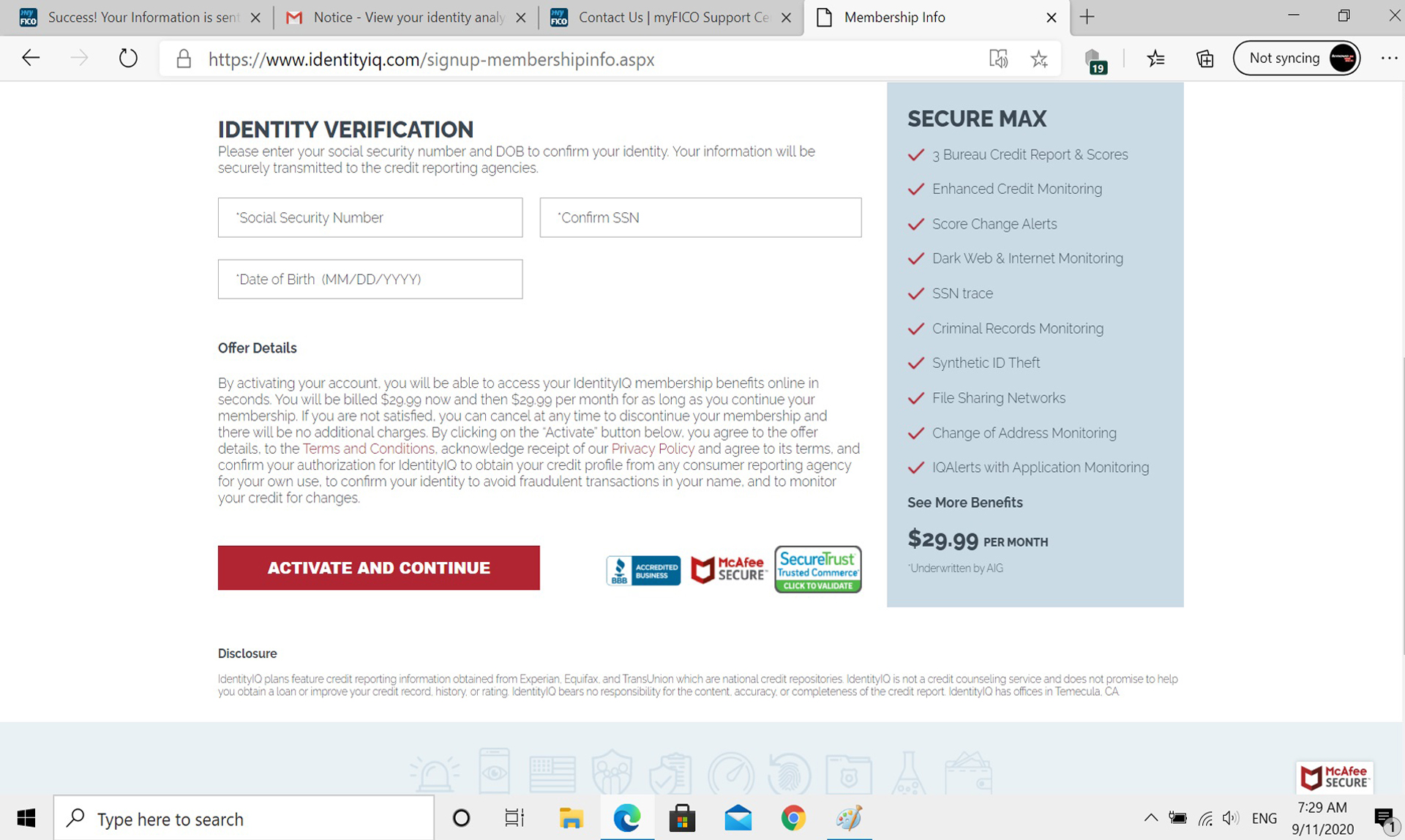

IdentityIQ: Setup

Opening an IdentityIQ account was easy, but sometimes the site’s responsiveness was slow, making the process a little frustrating. All told, it took about 12 minutes to enroll in the IdentityIQ SecureMax service.

On the website, I chose to start a 7-day trial and entered my name and email address, then picked a password and typed in my address and phone number. The site also wanted to know my Social Security number, date of birth and whether I had resided at the same address for at least six months.

I paid for a subscription with a credit card. IdentityIQ does not accept PayPal, but it can link up with the Prism payment service.

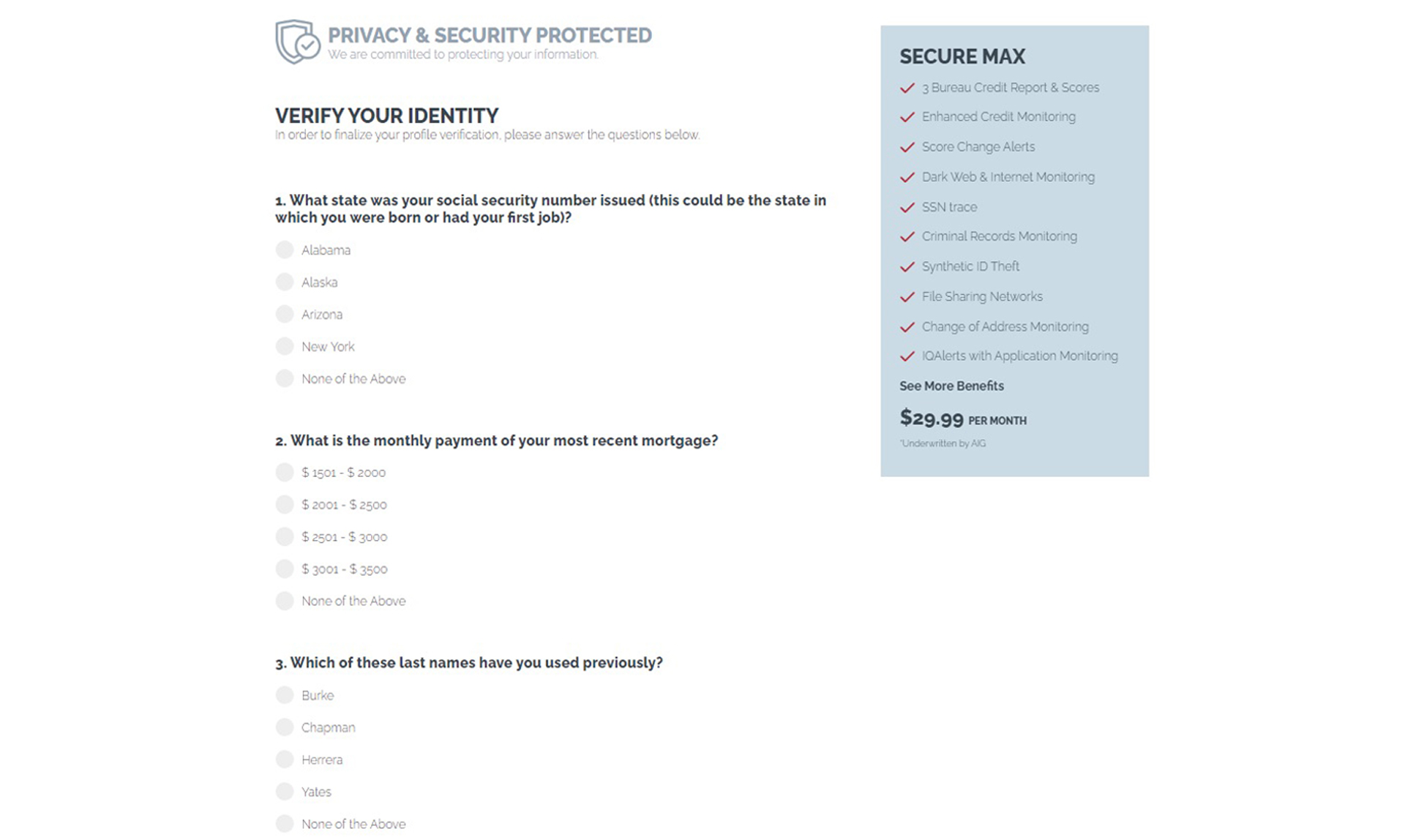

The site’s identity-verification section required me to answer three questions about my past that included information about my current mortgage, where my Social Security card had been issued and if I had used any other names in my life.

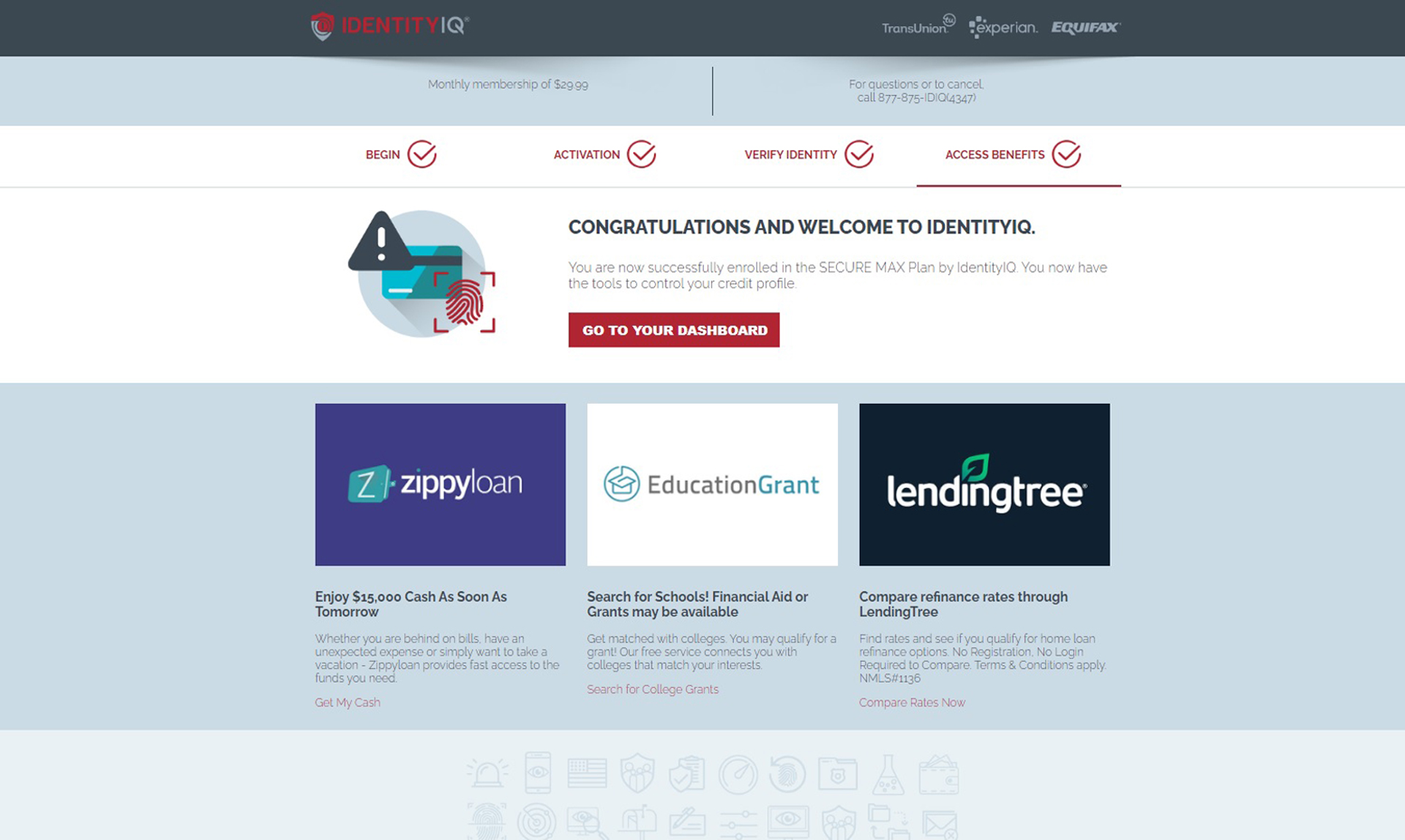

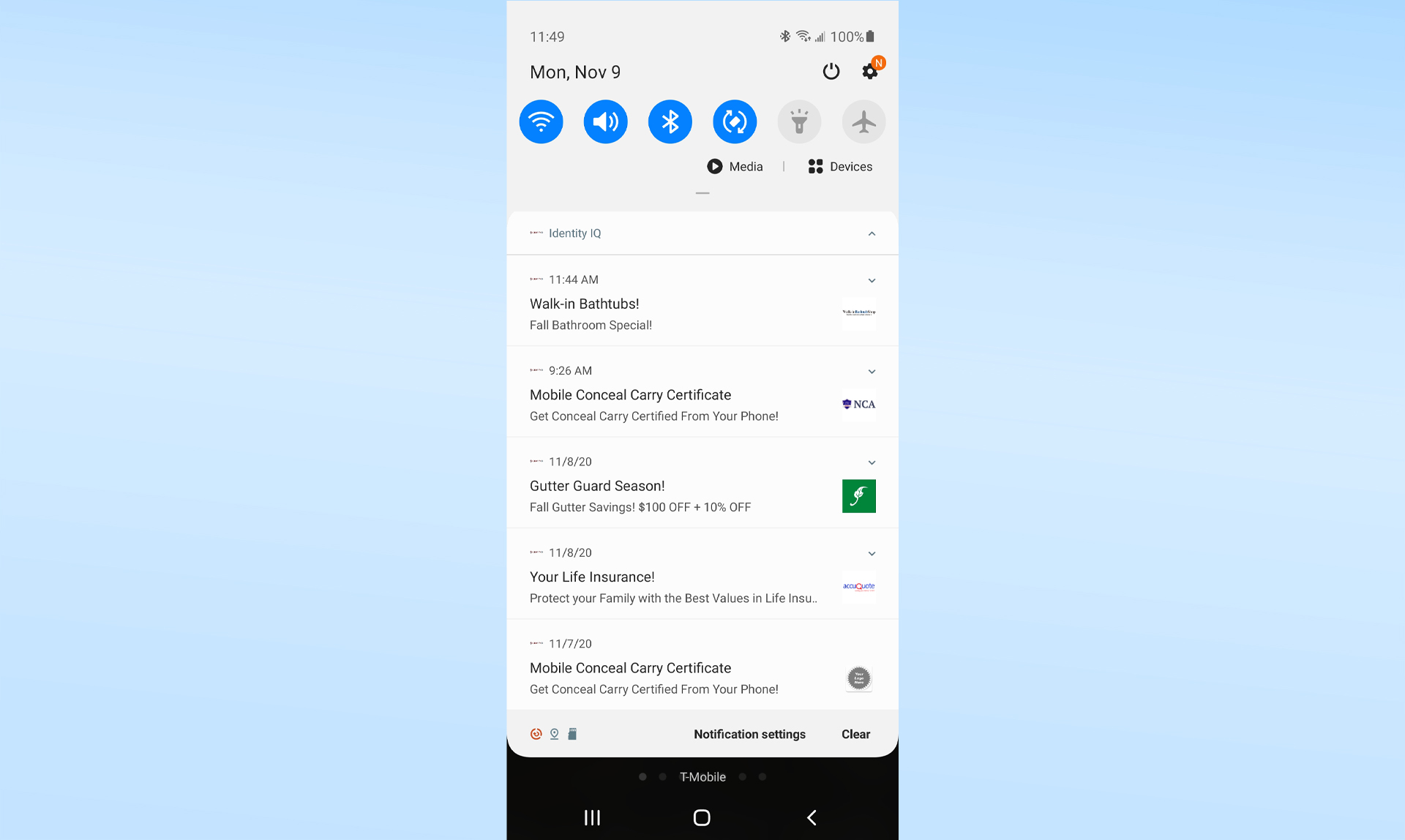

After I was all set, I got a Welcome to IdentityIQ screen that, unfortunately, included solicitations from three different loan companies. I later got push notifications from IdentityIQ on my phone about walk-in showers, concealed-carry permits for guns and refinancing offers.

These ads were off-putting, to say the least, but since this review was first published, IdentityIQ said it had ended the practices of sending push notifications and putting third-party ads on the welcome page.

IdentityIQ says all the data you enter is protected by encryption both while in transit and when it’s stored on IdentityIQ’s servers. But rather than wiping all your data clean when you cancel the service, IdentityIQ says it keeps all the metadata in place in case you later want a report from when you were a subscriber.

IdentityIQ’s customer support is mixed. The company has technicians and identity-restoration experts on call 24/7 but staffs its customer-support line Monday through Friday from 7 a.m. to 7 p.m. Central time and Saturdays from 8:30 a.m. to 5 p.m.

There’s no address to which you can directly send an email message, and no chat window to communicate in real-time with support personnel. The company will address general concerns but not customer-support questions over email, so I had to dial their number to ask basic questions about the service.

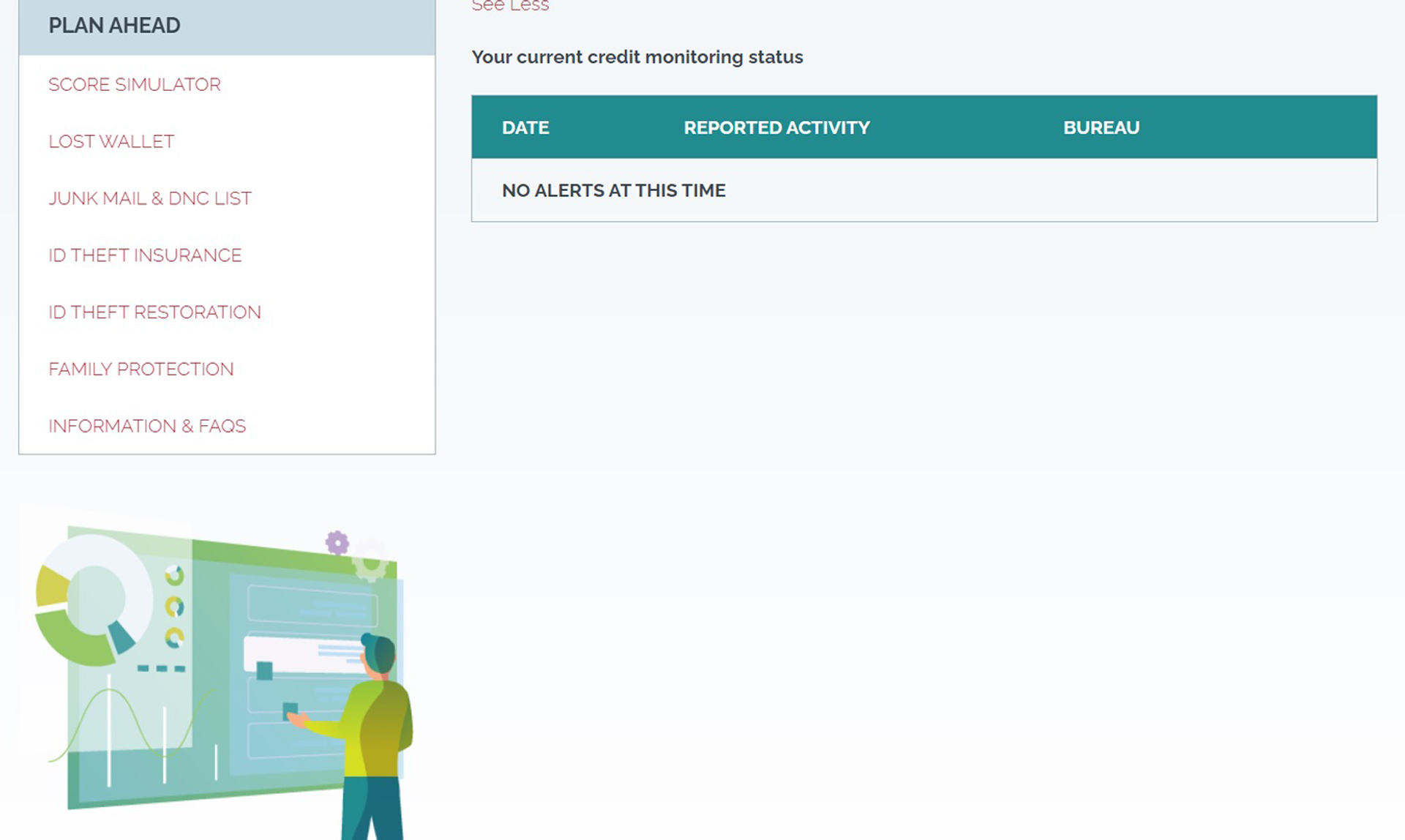

There is no dedicated customer-support section on the IdentityIQ website, just snippets here and there of helpful items, such as how to check problems with a credit report. The closest thing to a customer-support section is Information & FAQs, in the Contact Us section, but it lacks any link to get help immediately.

IdentityIQ: Interface and utilities

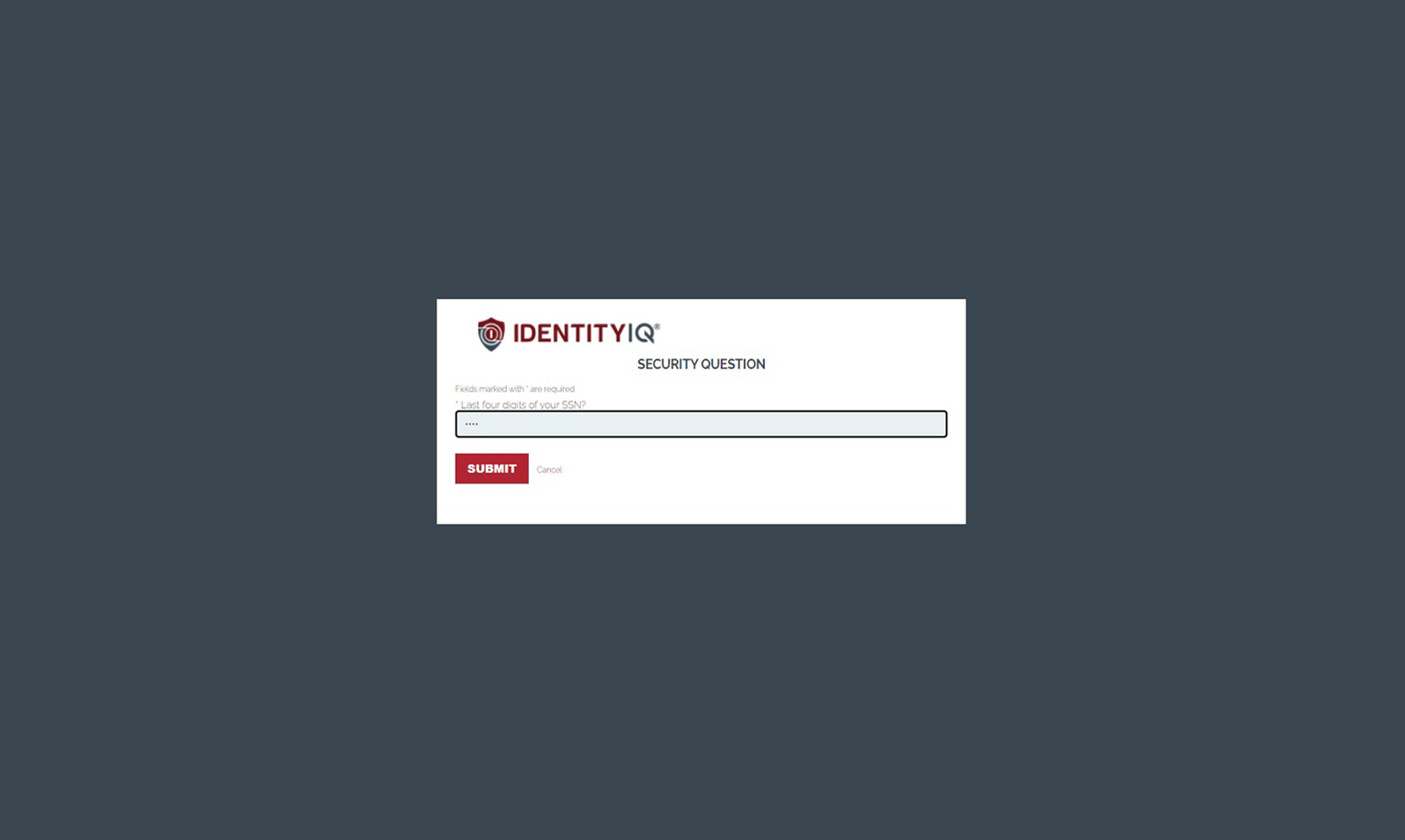

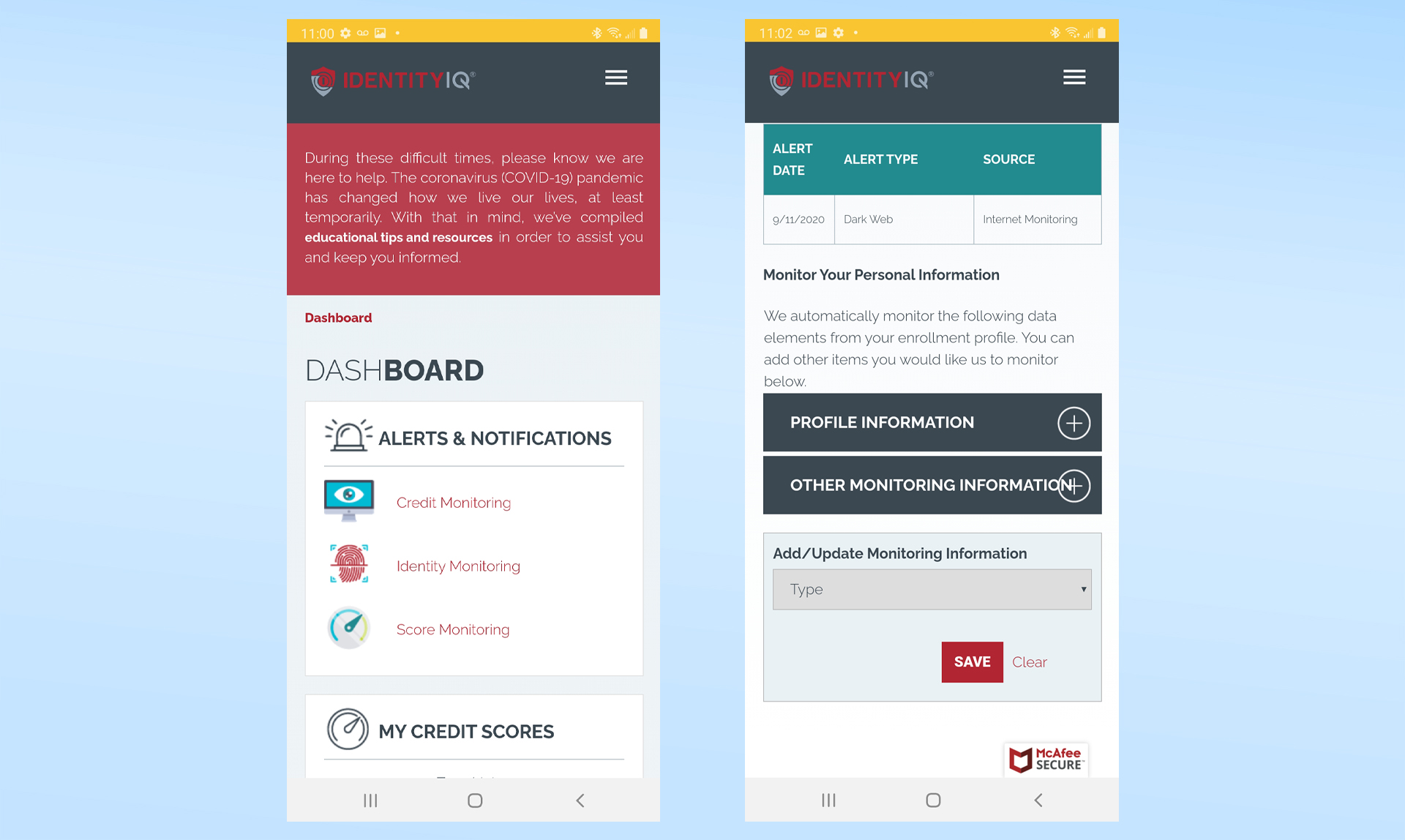

IdentityIQ once had mobile apps for phones and tablets, but now uses the browser interface across all devices. IdentityIQ does not offer two-factor authentication (2FA), but the website sometimes asks for the last four digits of your Social Security number for extra verification.

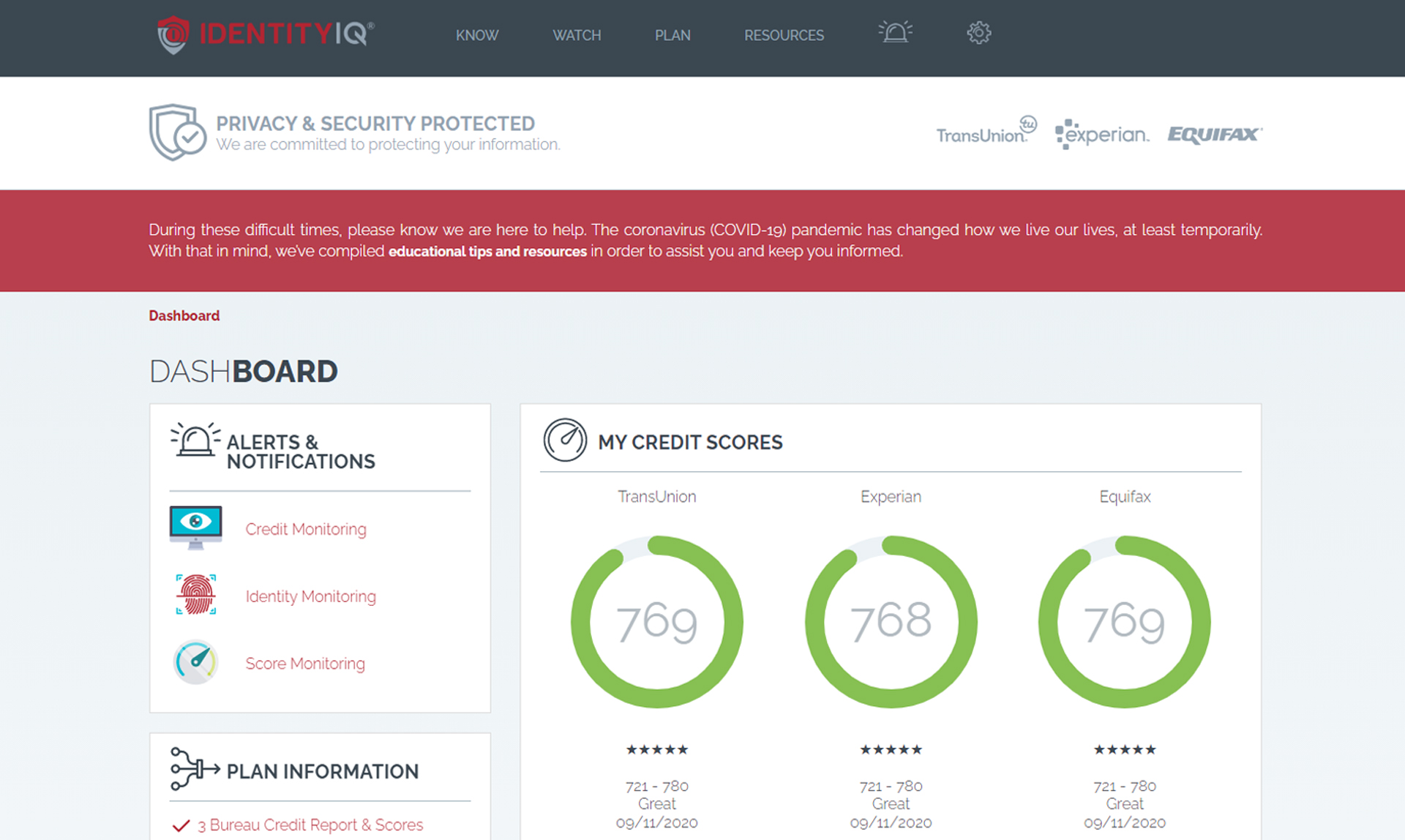

On my notebook computer, the IdentityIQ site’s main page displayed one of the most comprehensive statements of my identity and credit health I’d ever seen. On the other hand, there was so much there that I had to zoom out to 25% to take it all in.

The IdentityIQ web dashboard prominently shows your three credit scores along with their dates and a tracker that looks at the score changes over time. At any time, you can view the details of the most recent monthly credit report from each credit bureau. You can buy additional credit reports for $15 each or reports from all three bureaus for a reasonable $25.

The IdentityIQ web interface puts major categories like Credit, Identity and Score Monitoring up front. Click or tap each to get more details. All the elements are in your face with links to detailed descriptions.

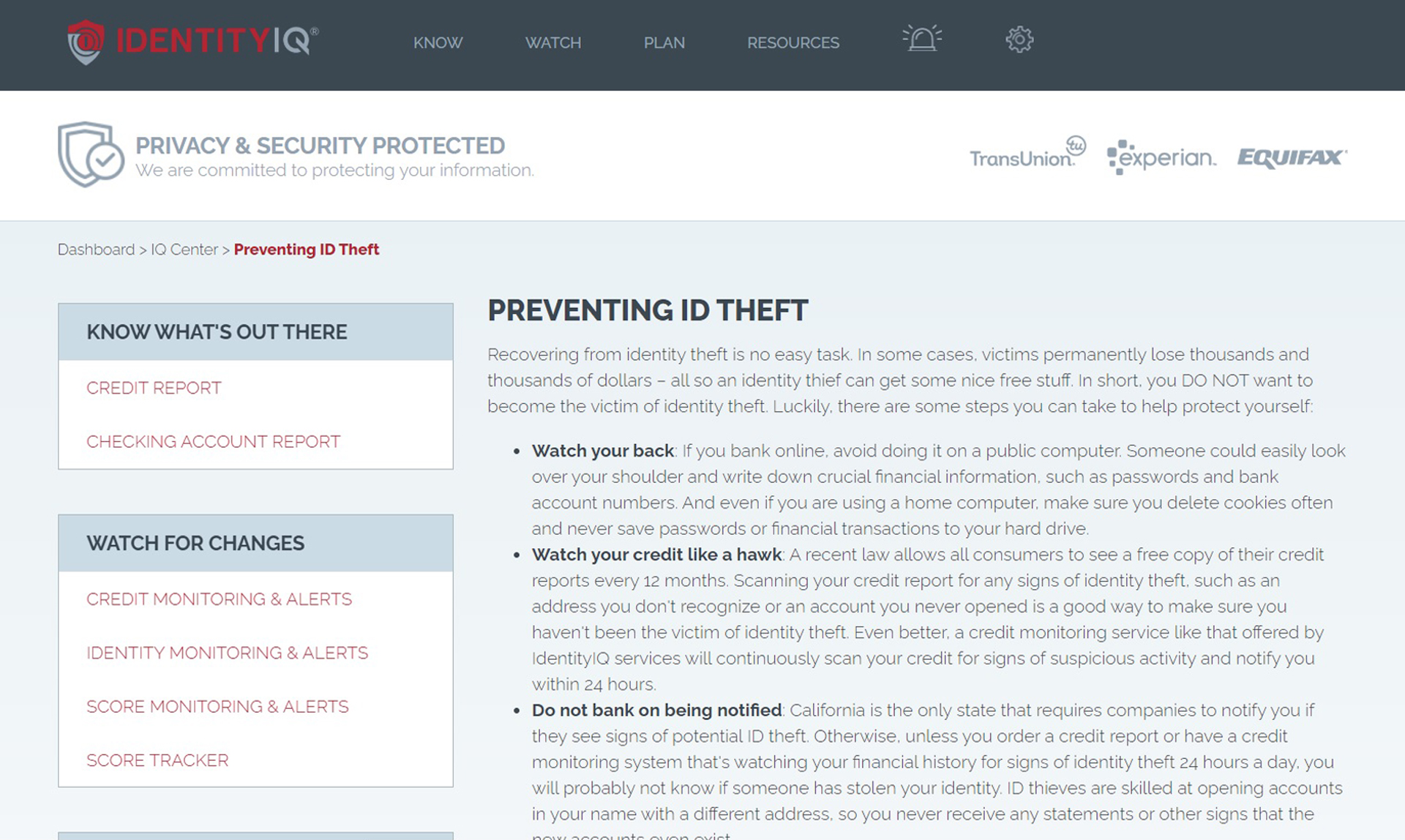

IdentityIQ offers articles about how to preserve your credit and avoid phishing scams, plus advice on avoiding synthetic identity theft. Near the bottom of the dashboard is a link to IdentityIQ’s powerful IQ Center, which includes help on improving your credit scores, an explanation of credit monitoring and lessons for children about credit.

The website interface on iPhones, iPads and Android phones and tablets looks like it actually is an app, with an easy-to-read format. It displays your latest credit scores plus Your most recent credit score, and alerts about your identity.

The alerts are to the point, but you’ll need to scroll through lots of explanatory material to find them. I missed a couple of alerts because of this.

IdentityIQ: Cancellation

I had to call IdentityIQ’s support line to cancel the service. It took only four minutes, but the support staffer read me a combination warning and discount offer to try to get me to stay. Cancellation took effect immediately and I quickly received an email confirmation.

IdentityIQ review: Bottom line

Identity IQ’s cheapest identity-theft-protection services is very inexpensive, and its top-line Secure Max plan offers monthly reports from all three credit agencies. We’re glad to see that it has added discounts for prepaying for a year at a time,

On the other hand, even the flagship IdentityIQ Secure Max service lacks the latest essentials in identity-theft protection, such as investment-account or payday-loan monitoring. It would also be nice to have two factor authentication (2FA), although the new Bitdefender antivirus software is a plus. It’s also good to see that IdentityIQ has stopped sending ads to paying clients.

If you want more protective plans, look to IdentityForce UltraSecure + Credit for excellent protection at a bargain rate, or LifeLock Ultimate Plus for comprehensive identity protection with a full security suite. Meanwhile, MyFICO offers the best credit monitoring of any service we’ve tested if you can afford it.

This review was originally published April 22, 2021 and has since been updated.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.