Micron fiscal Q4 results beat expectations, outlook misses by a mile | ZDNet

Memory-chip giant Micron Technology this afternoon reported fiscal Q4 revenue and profit that both topped Wall Street’s expectations, but an outlook for the current quarter’s revneue and profit that was well below consensus.

The report sent Micron shares down 4% in late trading.

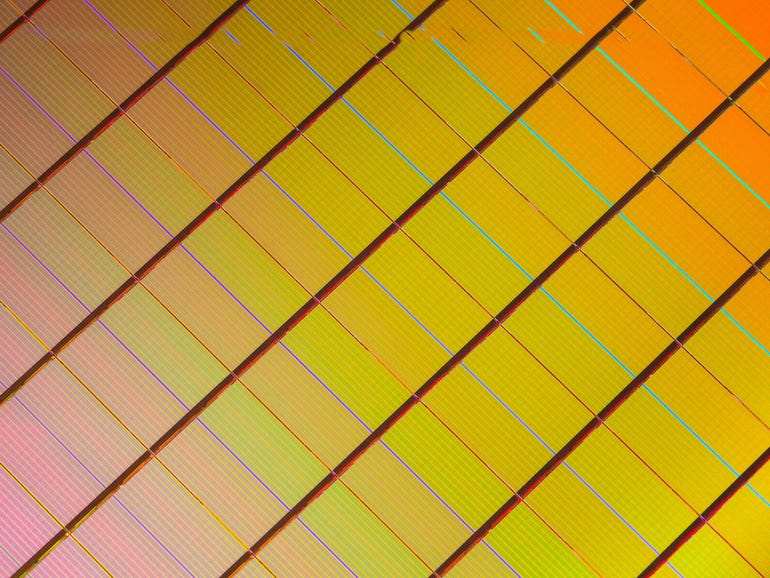

CEO Sanjay Mehrotra said the company’s “outstanding fourth quarter execution capped a year of several key milestones,” noting that the company in the fiscal year had “established DRAM and NAND technology leadership, drove record revenues across multiple markets, and initiated a quarterly dividend.”

Added Mehrotra, “The demand outlook for 2022 is strong, and Micron is delivering innovative solutions to our customers, fueling our long-term growth.”

Revenue in the three months ended in August rose to $8.27 billion, yielding a net loss of $2.42 a share, excluding some costs

Analysts had been modeling $8.23 billion and $2.33 per share.

Micron’s gross profit margin on a non-GAAP basis came in at 47.9%, which was up thirteen percentage points from the year-ago Q4.

For the current quarter, the company sees revenue of $7.45 billion to $7.85 billion, and EPS in a range of $2 to $2.20 per share. That compares to consensus for $8.54 billion and $2.53 in profit per share.

Gross profit is expected in a range of 46% to 48%.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.