PAN Card Reprint: How to apply for a duplicate PAN Card online, documents required, eligibility, charges, and more

A PAN card serves as a proof of identity (PoI) for an Indian citizen and is mandatory to carry out any financial transaction like opening a bank account, making an investment, etc. Every Permanent Account Number is unique to an individual and is valid for a lifetime. In case the PAN card is lost, misplaced, or damaged, one can easily apply for a PAN card reprint online. Here’s a guide on how you can apply for a duplicate PAN card online, eligibility and charges for the same, documents required, and other related info.

What is a Duplicate PAN card?

A duplicate PAN card is issued to an individual by the Income Tax department in case of loss, damage, or theft of the original document. It is an exact replica of the original PAN card with the same 10-digit unique alphanumeric number. Moreover, the duplicate is just as valid and can be used anywhere and everywhere without any issue.

When can you apply for a duplicate PAN card?

There are different scenarios under which you may need to apply for a duplicate PAN card. Here are the most common reasons for PAN card reprint:

- Loss/theft of the original PAN card

- Original PAN card gets misplaced

- Damage to the existing PAN card

How to apply for reprint of PAN card online

It’s quite easy to get a duplicate PAN card online through TIN-NSDL and UTIITSL websites. All you need to do is follow these steps to apply for PAN card reprint.

via TIN-NSDL portal

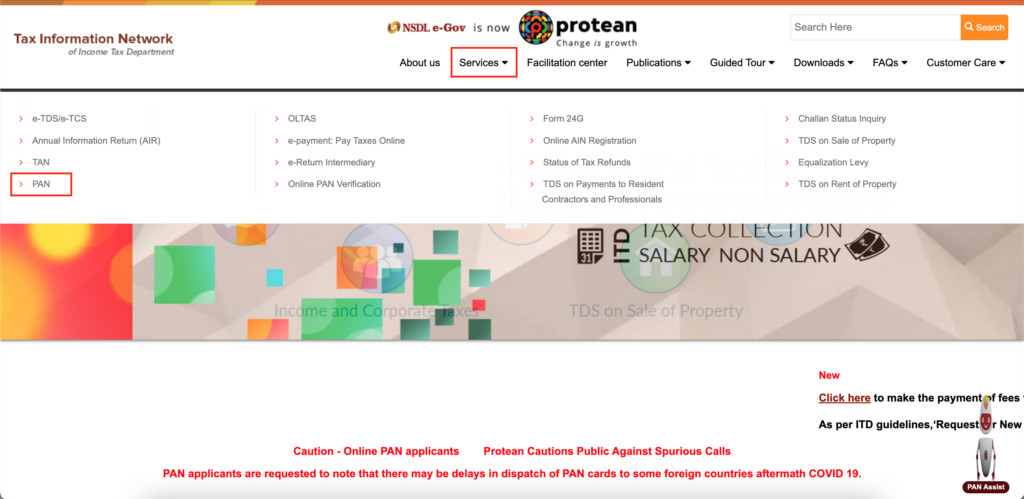

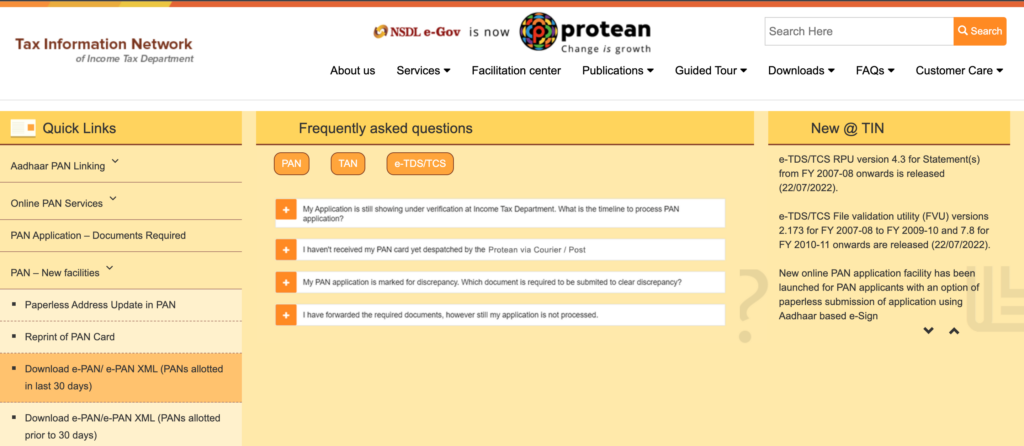

- Open the web browser of your choice and type protean-tinpan.com to open the official website of Tax Information Network – Protean (formerly NSDL).

- Go to Services > PAN, scroll down the page to find Reprint of PAN Card and tap on the Apply option under the header.

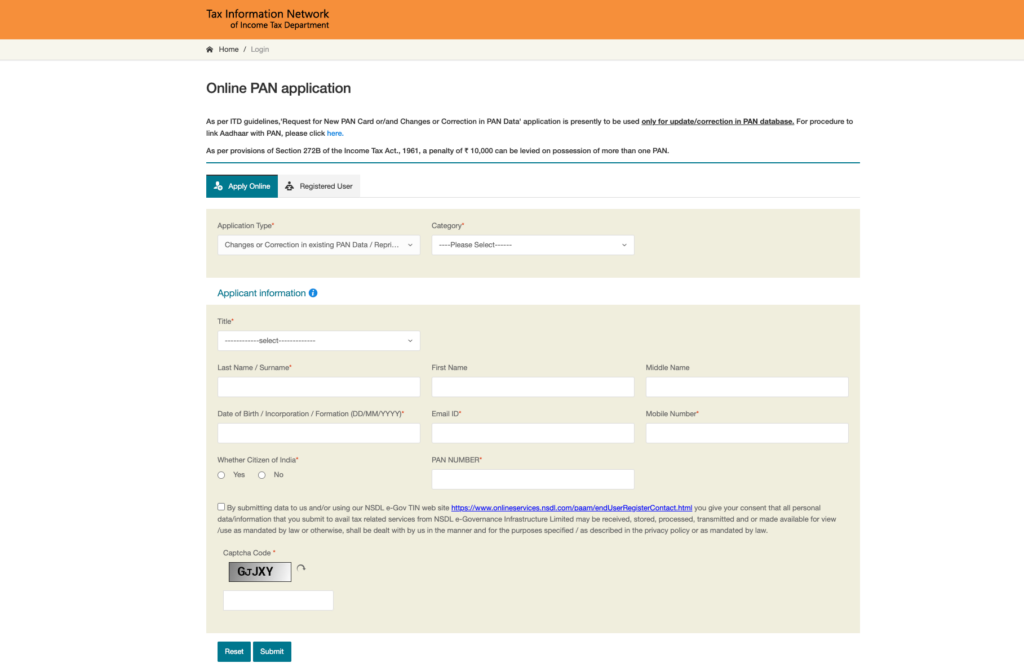

- An online PAN application will open on your screen. From the drop-down list under Application Type, pick Changes or Correction in existing PAN Data/Reprint of PAN Card (No changes in existing PAN Data) and select the Category.

- Next, fill in the Applicant information marked as mandatory (*), enter the Captcha Code, and click on Submit.

- A token number will be generated for your PAN card reprint application and sent to your e-mail ID provided in the application form for future reference. Make a note of the same and click on Continue with PAN Application Form.

- Fill in all the required information on the Personal Details page and choose the mode of PAN application form submission from the three available options:

-

- Submit digitally through e-KYC & e-Sign (Paperless) – requires Aadhaar card details and digital signature (DSC) for online application form submission.

- Submit scanned images through e-Sign – requires Aadhaar card information and scanned images of your photograph, signature and other documents for online application form submission.

- Forward application documents physically – requires you to send the printed acknowledgement form and document copies to the PAN services unit, NSDL via registered post.

- Next, choose between a physical PAN card or an e-PAN card. In the case of the latter, a valid e-mail ID will be required. The e-PAN card will be sent to this address.

- Fill out the Contact & other details and Document details sections and then, submit the application.

- You’ll be redirected to the payments page. Once you make the payment using your preferred mode, a downloadable acknowledgement receipt will be generated. Save and print this acknowledgement for future use.

- You can use the 15-digit acknowledgement number to check the duplicate PAN card application status. Usually, the duplicate PAN is issued within 15-20 working days of receiving the application.

Via UTIITSL website

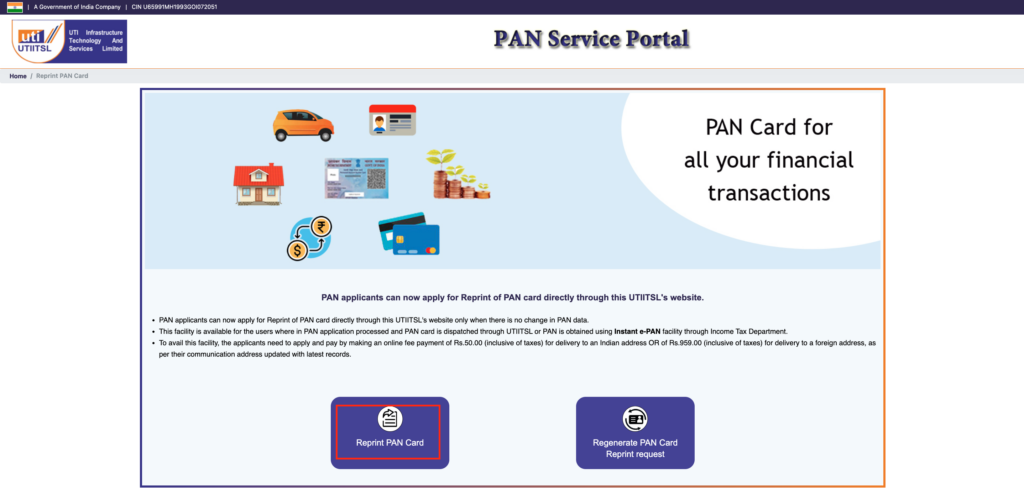

- Go to the web browser of your choice and type www.pan.utiitsl.com to open the PAN service portal of UTI Infrastructure Technology and Services Limited (a government-owned financial service provider in India).

Step 2: On the page that opens, read the terms and conditions to ensure that you meet the criteria and then, click on Reprint PAN Card. (Note: If you wish to get an e-PAN, simply click on Download e-PAN).

- Fill in the fields marked as mandatory (*) including your PAN number, Date of Birth and Captcha code and click on Submit. You can also enter your Aadhaar number and GSTIN number (if applicable).

- You’ll be redirected to the payments page. Once you make the payment using your preferred mode, your application would be successfully submitted and you’ll receive a PAN reprint application number. Save this number for future use.

- You can use the application number to check the status of your PAN card reprint application. Usually, the duplicate PAN is issued within 2 weeks of receiving the application.

Documents required to apply for PAN card reprint

Here is a list of documents required to apply for a duplicate PAN card online:

- Self-attested copy of Proof of Identity (Aadhaar, voter ID, driving license, passport, ration card, etc.)

- Self-attested copy of Proof of Address (Aadhaar, voter ID, driving license, passport, utility bills, bank account statement, etc.)

- Self-attested copy of Proof of Date of Birth (Aadhaar, voter ID, driving license, birth certificate, matriculation certificate, passport, etc.)

- PAN allotment letter or self-attested copy of original PAN card

Click here to get a complete list of supporting documents required for PAN card reprint.

via UTIITSL

Eligibility for reprint PAN card application

Any taxpayer in India is eligible to apply for a duplicate PAN card. But apart from individuals, other taxpayer categories need to have an authorised signatory to file the PAN card reprint application. Below is a list of all the eligible taxpayers and their authorised signatories.

|

Taxpayers eligible for PAN card reprint |

Authorised Signatories |

|

Individuals |

Self |

|

Limited Liability Partnerships (LLP)/Firms |

Any partner of the LLP/firm |

|

Companies |

Any director/s of the company |

|

Hindu Undivided Families (HUFs) |

Karta of the HUF |

|

Association of Persons (AOPs)/Body of Individuals/AOPs Trust/Local Authority/Artificial Juridical Person |

Authorised signatory covered under Section 140 of Income Tax Act, 1961 |

Charges for PAN card reprint application

During the duplicate PAN card application process, you’ll have to choose whether you want a physical copy or e-PAN card. Here are the charges for obtaining a duplicate PAN card:

For a physical PAN card

|

Mode of PAN application |

Particulars |

Fees (exclusive of applicable taxes) |

Fees (inclusive of applicable taxes) |

|

Physical mode |

Dispatch of physical PAN card in India (communication address is in India) |

91 |

107 |

|

Dispatch of physical PAN card outside India (foreign address is provided as communication address) |

862 |

1017 |

|

|

Paperless modes (e-KYC & e-Sign/e-Sign scanned based/DSC scanned based) |

Dispatch of physical PAN card in India (communication address is in India) |

86 |

101 |

|

Dispatch of physical PAN card outside India (foreign address is provided as communication address) |

857 |

1011 |

|

|

PAN card reprint request submitted through a separate online link |

Dispatch of physical PAN card in India (communication address is in India) |

42 |

50 |

|

Dispatch of physical PAN card outside India (foreign address is provided as communication address) |

813 |

959 |

For an e-PAN card

|

Mode of PAN application |

Particulars |

Fees (exclusive of applicable taxes) |

Fees (inclusive of applicable taxes) |

|

Physical mode |

Dispatch of e-PAN card at the e-mail ID provided in the application form |

61 |

72 |

|

Paperless modes (e-KYC & e-Sign/e-Sign scanned based/DSC scanned based) |

Dispatch of e-PAN card at the e-mail ID provided in the application form |

56 |

66 |

Note: The charges for obtaining a duplicate PAN card through UTIITSL are INR 50 for Indian addresses and INR 959 for delivery to a foreign address. All charges are inclusive of taxes.

Who can make the payment for a PAN card and how?

If you have opted for the physical mode during the duplicate PAN card application, the payment can be made through Credit Card/Debit Card or Net Banking. But in case the communication address is outside India, the applicant can also make the payment through a demand draft – payable in Mumbai. In the case of online PAN card reprint application through paperless modes (e-KYC & e-Sign, e-Sign scanned based and DSC scanned based), the payment can be made only through Credit Card/Debit Card or Net Banking.

The table below lists the authorised persons who can make the payment for a duplicate PAN card, depending on the applicant category:

|

Category of Applicant |

Payment can be made by/for |

|

Individual |

Self, immediate family members |

|

Limited Liability Partnerships (LLP)/Firms |

Any partner of the LLP/firm |

|

Companies |

Any director/s of the company |

|

Hindu Undivided Families (HUFs) |

Karta of the HUF |

|

Association of Persons (AOPs)/Body of Individuals/AOPs Trust/Local Authority/Artificial Juridical Person |

Authorised signatory covered under Section 140 of Income Tax Act, 1961 |

Other things to know when applying for reprint of PAN card

- In case of loss of PAN card by theft, it is mandatory that you file an FIR at the nearest police station. A copy of the FIR needs to be sent to TIN-NSDL office along with other required documents for PAN card reprint application.

- When sending the duplicate PAN card application by registered post, you must write “15-digit Acknowledgement Number – Application for Reprint of PAN or Application for changes or correction in PAN data” on top of the envelope.

- In case the applicant is a minor, his/her Aadhaar number needs to be mentioned in the duplicate PAN card application form for authentication.

- If the applicant uses a thumb impression (instead of a signature), it will be verified by a Magistrate, Gazetted Officer or Notary Public using the official stamp and seal.

- If the payment is made through a credit card/debit card, an additional 2% charge will be levied by the bank providing the gateway facility. In case a foreign address is used as a communication address, exchange or conversion rates may also be applicable.

How to check the status of a duplicate PAN card?

You can easily check the status of your duplicate PAN card application through the TIN-NSDL website. Here’s a step-by-step guide to take you through the process for the same:

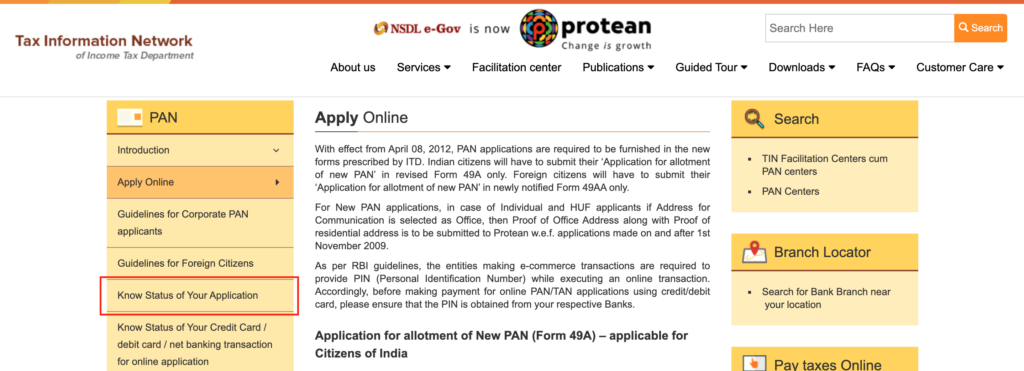

- Go to the official website of Tax Information Network – Protean (formerly NSDL).

- Click on Services > PAN and from the list of options on the left side of the screen, tap Know Status of Your Application.

- Select PAN – New/Change Request from the drop-down menu along the Application Type option.

- Enter the 15-digit acknowledgement number and captcha code.

- Click on the Submit button.

The status of your duplicate PAN card application will be displayed on the screen.

Note: In case you have opted for the paperless mode during the PAN card reprint application process, you’ll get a download link for your e-PAN card copy on this page itself.

How to download a duplicate e-PAN card?

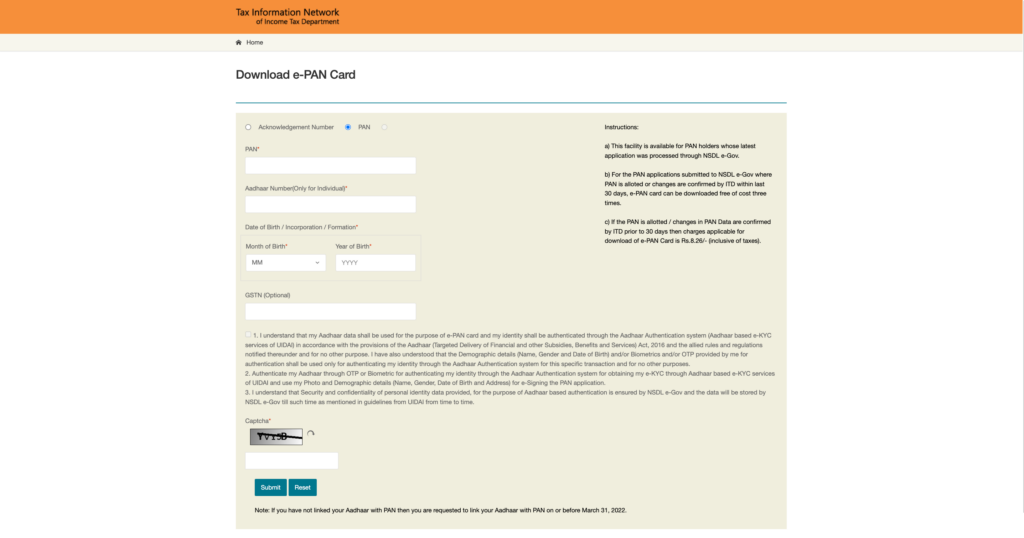

The TIN-NSDL website allows you to instantly download a soft copy of your PAN card or e-PAN card by providing your acknowledgement number or Aadhaar number. Here’s how:

Using acknowledgement number

- Click here to open the TIN-Protean (formerly NSDL) portal.

- Scroll down to find the Quick Links menu and under the header, select PAN – New Facilities > Download e-PAN/e-PAN XML (PANs allotted in last 30 days).

-

![]()

Select the Acknowledgement Number option at the top of the screen.

- Enter the 15-digit acknowledgement number and your month and year of birth in the respective fields.

- Enter the Captcha code and click on the Submit button to download your e-PAN card free of cost.

Using Aadhaar number

- Click here to open the TIN-Protean (formerly NSDL) portal.

- Scroll down to find the Quick Links menu and under the header, select PAN – New Facilities > Download e-PAN/e-PAN XML (PANs allotted in last 30 days).

- Select the PAN option at the top of the screen.

- Enter your Aadhaar number, month and year of birth and GSTN (optional) in the respective fields.

- Tick the box next to the listed terms and conditions, enter the Captcha code and hit the Submit

- You’ll be redirected to a new webpage where you need to scroll down and select the option to generate OTP (One-Time Password) on your contact number and e-mail ID listed in the application.

- Enter the OTP received on your phone or over mail in the respective field.

- Now, click on the Validate button to receive a soft copy of your duplicate PAN card.

FAQs

1. How long will it take to get a duplicate PAN card?

It normally takes two weeks for the processing and dispatch of the duplicate PAN card.

2. Can I apply for a duplicate PAN card offline?

Yes, you can place a request for PAN card reprint offline as well. Follow the below steps:

- Click here to download the application form for “New PAN card or/and Changes or Correction in PAN Data” from the TIN-NSDL website.

- Take a printout of the form and fill in all the required details carefully following the instructions given in the form.

- Mention your 10-digit PAN number for reference.

- Individual applicants need to attach two recent passport-size photographs and cross-sign them ensuring that the face isn’t covered.

- Fill other necessary details and sign the form or provide the impression of your left thumb.

- Attach all the supporting documents with the form including proof of identity, proof of address and proof of date of birth along with the payment and send it to the NSDL facilitation centre.

- Once the payment is received, you’ll receive a receipt containing the 15-digit number acknowledgement number. Your application will be forwarded to the IT-PAN services unit for further action.

- The duplicate PAN card is normally dispatched within two weeks of processing of the application. You can use the acknowledgement number to track the progress of your duplicate PAN card application in the meanwhile.

3. Can I hold two PAN cards?

No, it is illegal to have more than one card. As per provisions of Section 272B of the Income Tax Act, 1961, a penalty of 10,000 INR will be levied on anyone with two or more PAN cards.

4. How to surrender the duplicate PAN card?

Since it is against the law to hold more than one PAN card, there is a provision to surrender any additional PAN cards having the same or different numbers that you may hold. All you need to do is follow the below steps to surrender the duplicate PAN card to IT department.

- Write a letter to your accessing officer stating that you wish to return the duplicate PAN card and provide all the details like your full name, date of birth and details of the PAN card to be retained and the one to be surrendered.

- Speed-post the letter to the accessing officer or hand it over in person.

- You’ll receive an acknowledgement receipt as proof that the duplicate PAN card is cancelled.

5. Do I have to re-link my Aadhaar with the duplicate PAN card?

No, there won’t be any need to link your Aadhaar and the duplicate PAN card (if the PAN number hasn’t changed).

6. I misplaced my PAN card and can’t recall my PAN number. What to do?

If you don’t remember your PAN details, you can use the “Know your PAN” service offered by the Income Tax department to be able to apply for a reprint of your lost PAN card.

7. How can I get more information related to PAN card?

You can connect with the Income Tax Department—PAN services unit through the following:

- Call PAN/TDS call centre at 020 – 27218080

- Fax: 020-27218081

- E-mail: [email protected]

- Write to: INCOME TAX PAN SERVICES UNIT (Managed by Protean e-Governance Infrastructure Limited), 5th Floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune – 411 016.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.