Robinhood simplifies investing with new Cash Card and spending account | ZDNet

Source: Robinhood

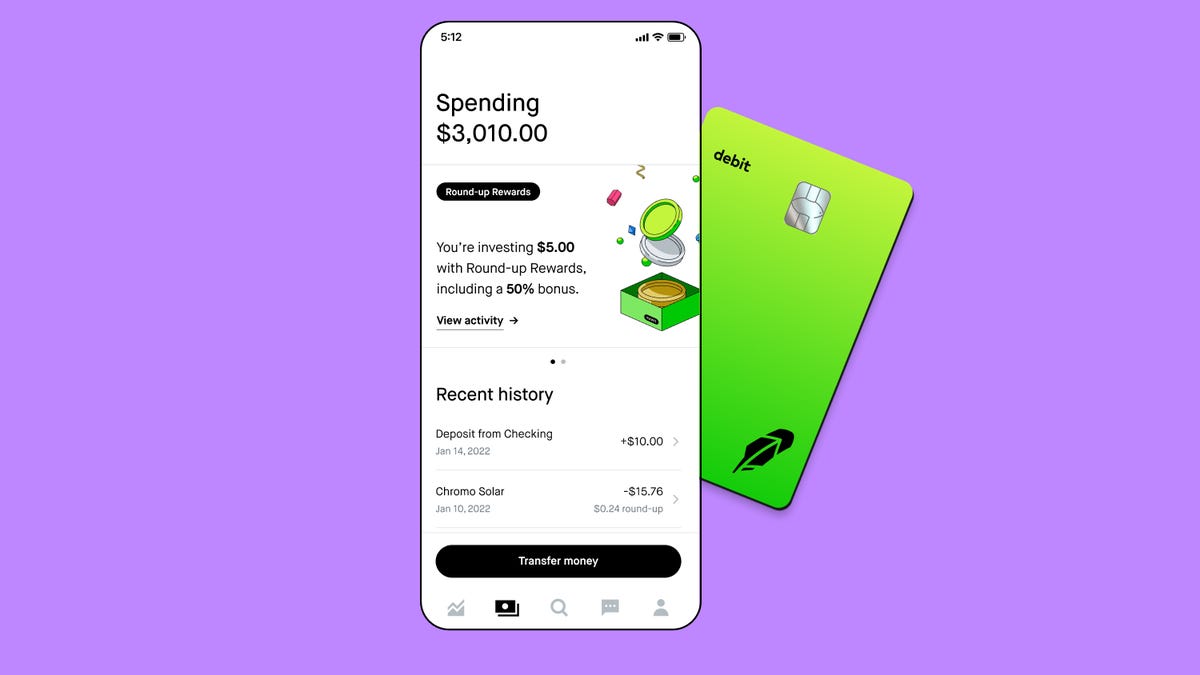

Robinhood today announced its Cash Card, a debit card that is connected to a new spending account separate from users’ brokerage account. The Cash Card features round-up investments with a weekly bonus, few fees, early direct deposit, and a split-check feature for recurring investments.

The new debit card will replace the company’s current debit card as well as its Cash Management program. Starting today, current debit cardholders will have an opportunity to sign up for the waitlist for the new Cash Card.

The card features a round-up investment feature which rounds up cardholder’s purchases to the nearest dollar and invests the difference into a stock or cryptocurrency of their choice, which can be changed at any time.

Additionally, the card features a weekly round-up bonus which provides cardholders a 10% to 100% bonus based on their weekly round-up rewards. The bonus is then invested into the same stock or cryptocurrency. There are no overdraft fees, service fees, minimum deposits, or in-network ATM fees associated with the card.

The driving factor behind the new debit card, Robinhood said, is to make investing as easy as possible for new investors.

“A large portion of our customers will tell us, ‘I want to start investing but I don’t know how or I don’t have the funds to,’ so we realized there’s a way to make investing as easy as something that they’re really familiar with, which is spending,” Dennis Zhao, senior product manager at Robinhood, told ZDNet.

Users can now invest whenever they use the Cash Card. The round-up rewards are instantly applied to the stock or crypto selected by the user, and the weekly bonus — which is doled out every Monday and applied on Tuesday — is added to the stock or cryptocurrency based on those round-ups.

“If [Robinhood] could make investing as simple as swiping a card and buying a coffee, that would make investing open to a whole new generation of customers,” Zhao said.

For those new to investing, the company has integrated educational resources and a financial news stream of top stories into the app. Users can also use learn.robinhood.com as an educational resource for investing.

Customers have access to 24/7 customer support from within the app. The help section offers solutions for common issues customers may experience, but users can also choose phone support, describe their issue, and have someone from Robinhood call them to try to help.

The new Robinhood spending account

Starting today, Robinhood’s Cash Management program is no longer available for new signups, as the features are being rolled into the new debit card and its spending account.

“One of the things that we heard from customers with Cash Management is that they really didn’t like their cash being mixed together for spending and investing,” Zhao said.

Source: Robinhood

No longer will the brokerage account contain funds for both the debit card and user investments; a new spending account is being added into the app that will fund the debit card. Users can see their round-up rewards in real-time and funds can be moved instantly between the two accounts.

Users can also sign up for direct deposit and access their funds two-days early, as well as take advantage of the app’s split-check feature. Users can choose a dollar amount of each check to be invested into the stock or cryptocurrency of their choice, or a mix of both.

“Customers can put just a little bit of their paycheck aside for whatever investment they want. They can diversify, they can choose all mixes of stock and crypto that [Robinhood] offers. It’s a really easy way to invest just a little out of your paycheck without having to do much,” Zhao said.

Along with easy investments, the company hopes the early-pay feature will support the financial security of their clients.

“[Early direct deposit] helps customers with their liquidity. Some people get paid on Thursday but their bills are due on Friday, so [early pay] really helps reduce stress for our customers,” Zhao said. The earlier access to funds also lets investors get into the market two days earlier than they normally would.

The company additionally plans to release a rewards program in the near future. With inflation increasing, Robinhood hopes the Instant Savings program will provide users with savings on everyday purchases.

“In order for it to be a card someone uses everyday, we also want to help them save whenever we can,” Zhao said. The rewards with local and national merchants will require no activation and will automatically take place at the point of purchase, which users can see in the app when the program is released.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.