Samsung and Apple’s rollercoaster year in Europe nearly ended in a draw

While China, India, and the US tend to attract the highest amount of attention from both press and research firms as the world’s largest smartphone markets, it doesn’t take a seasoned industry pundit to tell that Europe is also a very important battleground for everyone from Samsung and Apple to Xiaomi, Oppo, and Huawei.

One year, three leaders

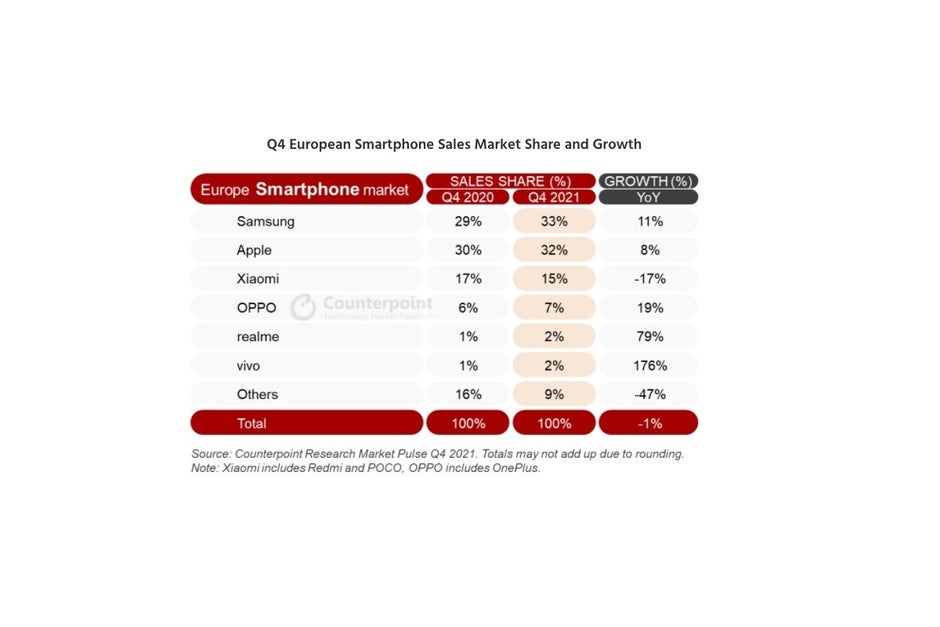

Samsung managed to eke out the narrowest possible quarterly win over arch-rival Apple during the October – December 2021 timeframe, holding a 1 percent market share advantage after the Cupertino-based tech giant finished 2020 with an eerily similar 30 to 29 percent victory for Q4.

What’s perhaps more important to highlight is that the gold and silver medalists both boosted their numbers compared to the final three months of 2020, unlike bronze medalist Xiaomi, which slipped from 17 to 15 percent share.

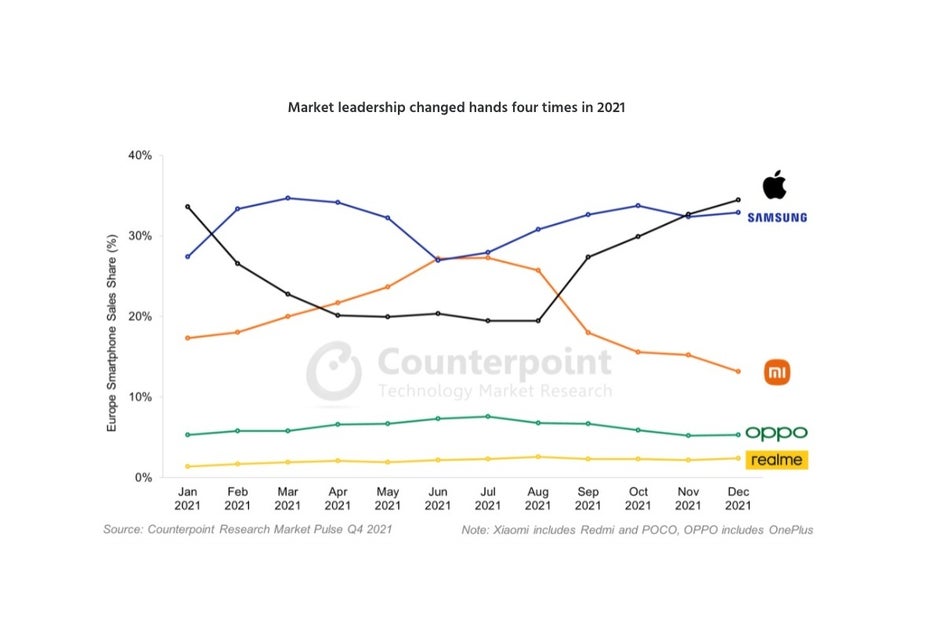

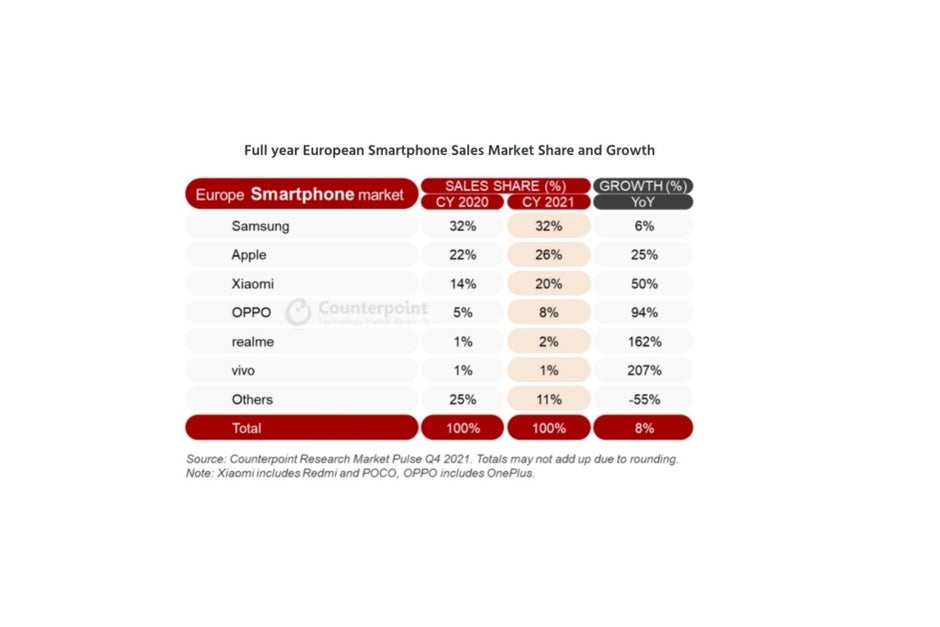

Xiaomi, mind you, was a constant thorn in Samsung and Apple’s side in 2021, ending the year with a new regional sales record after jumping no less than 50 percent overall from 2020.

Perhaps more impressively, Xiaomi was at one point in 2021 the top smartphone vendor on the old continent… for about 15 minutes, with Samsung and Apple one-upping each other multiple times over the year’s duration.

But Apple can be very pleased with its 25 percent year-on-year surge, especially in a year when total smartphone sales only grew by 8 percent, representing a “partial recovery” to lower than pre-pandemic volumes.

The growth champions all hail from China

It’s unclear what smartphone vendors are ranked sixth and seventh right now, but Counterpoint Research is naming Motorola, Nokia, and Honor among the less successful brands to watch in 2022 after important “resurgences” noticed in “recent months.”

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.