Top cloud providers in 2021: AWS, Microsoft Azure, and Google Cloud, hybrid, SaaS players | ZDNet

Cloud computing in 2021 has become the go-to model for information technology as companies prioritize as-a-service providers over traditional vendors, accelerate digital transformation projects, and enable the new normal of work following the COVID-19 pandemic.

And while enterprises are deploying more multicloud arrangements the IT budgets are increasingly going to cloud giants. According to a recent survey from Flexera on IT budgets for 2021, money is flowing toward Microsoft Azure and its software-as-service offerings as well as Amazon Web Services. Google Cloud Platform is also garnering interest for big data and analytics workloads. But hybrid cloud and traditional data center vendors such as IBM, Dell Technologies, Hewlett-Packard Enterprise, and VMware have a role too.

Meanwhile, Salesforce, ServiceNow, Adobe, and Workday are battling SAP and Oracle for more wallet and corporate data share. Salesforce and ServiceNow launched successful back-to-work enablement suites and cemented positions as major platforms.

Also: The best web hosting providers: Find the right service for your site

Key themes for 2021 include:

- The COVID-19 pandemic and the move to remote work and video conferencing are accelerating moves to the cloud. Enterprises increasingly are seeing the cloud as a digital transformation engine as well as a technology that improves business continuity. As work was forced to go remote due to stay-at-home orders, tasks were largely done on cloud infrastructure. Collaboration tools such as Microsoft Teams and Google Meet became cogs in the companies’ broader cloud ecosystem. Zoom not only lands subscription revenue, but also runs on cloud providers such as AWS and Oracle.

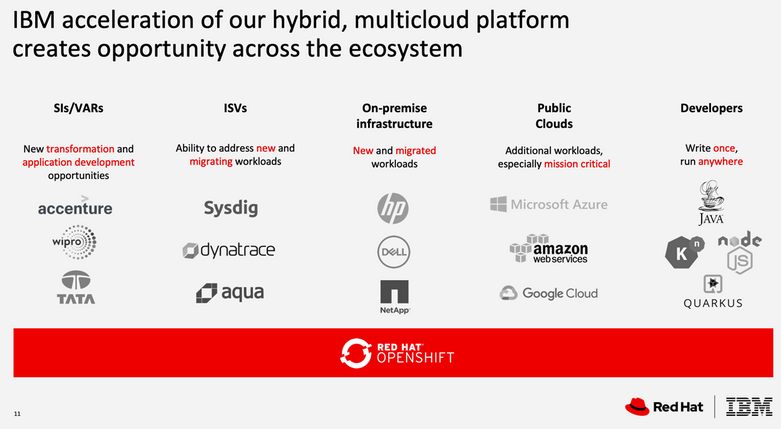

- Multicloud is both a selling point and an aspirational goal for enterprises. Companies are well aware of vendor lock-in and want to abstract their applications so they can be moved across clouds. The multicloud theme is being promoted among legacy vendors that have created platforms that can plug into multiple clouds — often with a heavy dose of VMware or Red Hat. (See: Multi-Cloud: Everything you need to know about the biggest trend in cloud computing and Multicloud deployments become go-to strategy as AWS, Microsoft Azure, Google Cloud grab wallet share). However, multicloud deployments still boil down to an AWS vs. Azure battle.

- The game is about data acquisition. The more corporate data that resides in a cloud the more sticky the customer is to the vendor. It’s no secret that cloud computing vendors are pitching enterprises on using their platforms to house data for everything from analytics to personalized experiences.

- Artificial intelligence, analytics, IoT, and edge computing will be differentiators among the top cloud service providers — as will serverless and managed services.

- Every flavor of cloud vendor wants to be a management layer to manage your other clouds. Public cloud vendors such as Google Cloud Platform and AWS have offerings to manage various cloud services. Traditional enterprise vendors such as Dell and HPE do too. Which platform becomes that “single pane of glass” for cloud management will be positioned well.

- Sales tactics that play to fear, uncertainty, and doubt will be the norm. Right around AWS re:Invent, there appeared to be a mindshare battle in the press as the big three sniped at each other across multiple industries. Google Cloud has been hiring executives to sell into industries and has ramped its Anthos hybrid cloud effort to close its AWS and Azure sales gap. (See: What is cloud computing? Everything you need to know)

- There’s a sales war happening by industry. Cloud providers are going vertical to corner industries. Gartner’s Magic Quadrant report on public cloud providers noted that the “capability gap between hyperscale cloud providers has begun to narrow; however, fierce competition for enterprise workloads extends to secondary markets worldwide.” Indeed, the financials from AWS, Microsoft Azure, and Google Cloud have all been strong.

Gartner

With that backdrop, let’s get to the 2020 top cloud computing vendors.

Infrastructure as a service

AWS was the first to offer cloud computing infrastructure as a service in 2008 and has never looked back. It’s launching new services at a breakneck pace and is creating its own compute stack that aims to be more efficient and pass those savings along. That plan isn’t likely to change as Adam Selipsky returns to become CEO of AWS as Andy Jassy takes over Amazon for Jeff Bezos.

AWS has expanded well beyond cloud compute and storage. If processors based on Arm become the norm in the data center, the industry can thank the gravitational pull of AWS, which launched a second-generation Graviton processor and instances based on it. If successful, the Graviton and the Nitro abstraction layer can be the differentiator for AWS in the cloud wars.

At re:Invent 2020, a virtual conference, AWS outlined custom processor roadmap, database advances and a bey of tools that solidify its lead in the cloud market. Jassy also took aim at Microsoft Azure in his keynote as well as Oracle and touted an AWS annual revenue run rate approaching $48 billion.

While 2020 will be the year known for Amazon’s ability to deliver goods during COVID-19 lockdowns, it’s still worth noting that AWS delivers the most operating income in the company.

The biggest question is whether enterprises are going to worry about AWS’ dominance as a digital transformation enabler. For now, AWS is becoming everything from a key AI and machine learning platform to call center engine to edge compute enabler.

Some key developments include:

- AWS rolls out S3 Object Lambda to process data for multiple applications

- Amazon makes Alexa Conversations generally available

- AWS’ Mac EC2 instances now support macOS Big Sur

- Amazon AWS says ‘Very, very sophisticated practitioners of machine learning’ are moving to SageMaker

- AWS builds out IoT, edge computing technical building blocks

- AWS starts gluing the gaps between its databases

- Amazon AWS analytics director sees analysis spreading much more widely throughout organizations

- Amazon unveils Amazon HealthLake, big data store for life sciences

- Amazon AWS unveils RedShift ML to ‘bring machine learning to more builders’

- AWS unveils new compute instances, including compute heavy C6gn powered by Graviton2

- AWS: Containers, serverless, and cloud-native computing oh my!

- AWS bolsters industrial IoT lineup with new Monitron, Panorama services

- Amazon’s Andy Jassy talks up AWS Outposts, Wavelength as the right edge for hybrid cloud

- AWS offers Mac EC2 instances: Here what it means for Apple, Apple Silicon, developers

Must read:

While AWS growth rates have been slowing relative to rivals, the base of revenue is much higher. There is little evidence that AWS isn’t gaining a larger portion of the enterprise IT cloud-spend. AWS has hybrid cloud partnerships with the likes of VMware, developers, ecosystem, and large enterprise customer base to remain in the lead.

Here’s what you need to watch with AWS in 2021:

The cheap and easy storyline is that Microsoft Azure and AWS are on a collision course to be the top cloud service provider. The reality is that the two foes barely rhyme.

Here’s why:

- There is still no publicly available data on Azure sales. Azure is the part of Microsoft’s cloud business that most rhymes with AWS, but is buried in the commercial cloud.

- Commercial cloud is a roll-up of multiple services from Microsoft. Enterprises are likely to buy a buffet that includes Azure but isn’t totally focused on it. That said, Microsoft commercial cloud annual revenue run rate is closing in on $70 billion.

- Microsoft Azure benefits from its software-as-a-service footprint. The reality is that we could easily take Microsoft out of the IaaS category and put it in the SaaS section since most of the revenue is derived from Office 365, Dynamics, and a bevy of other cloud services that are software-based over infrastructure.

- Nevertheless, Azure and its AI, machine learning, and history in the enterprise make it a formidable player. Azure has edge computing efforts.

The COVID-19 pandemic provided rocket fuel to Microsoft’s cloud business as a bevy of enterprises used Microsoft Teams for remote work. In addition, Microsoft wrestled with capacity issues due to demand. Those capacity issues continued throughout 2020. Microsoft addressed capacity issues at its Ignite conference after Gartner gave Azure high marks, but raised concerns about outages.

Also: Microsoft Teams: How to master remote work beyond the basics | TechRepublic cheat sheet on Microsoft Teams

Microsoft CEO Satya Nadella argued that the company’s cloud unit sits in the middle of digital transformation efforts. “We have seen two years’ worth of digital transformation in two months. From remote teamwork and to sales and customer service to critical cloud infrastructure and security, we are working alongside customers every day to help them stay open for business in a world of remote everything,” said Nadella.

To understand Azure’s competitive advantage, it helps to know some history courtesy of ZDNet’s Mary Jo Foley:

Simply put, Azure enjoys an incumbent role with enterprises as a cloud service provider, but pricing will blend multiple monetization models and bundles. The real battle between AWS and Microsoft will revolve around enterprises that go multi-cloud but want one preferred cloud service vendor. Will AWS or Microsoft be the preferred vendor? In that environment, Microsoft is a known commodity that can plug into Salesforce, which picked Azure for its Marketing Cloud, as well as other incumbents such as SAP, Oracle, and Adobe. In addition, Microsoft can pair its cloud offerings into its Microsoft 365 effort, which is a cloud and enterprise software buffet packaged for various industries but may have hidden costs if not negotiated properly.

Microsoft has also honed its ground game for hybrid deployments as it has deep partnerships with server vendors to create integrated stacks to target hybrid cloud and private cloud. Azure Arc, Azure Stack, and Azure Stack Edge are all examples of these hybrid efforts. Some efforts of note include:

In the end, the Microsoft Azure battle with AWS will boil down to a sales war and thousands of foot soldiers pitching enterprises. You may become a Microsoft cloud customer via Teams, Office 365, Dynamics, Azure, or some combination of them all. The reality is that you’ll have both top cloud service providers in your company and neither one will own the whole stack. Multi-cloud efforts will begin with having Microsoft and AWS in your company. The wallet-share trench war begins there. (See: Can AWS be caught? Here’s how its cloud computing rivals can improve their chances)

Must read:

Google Cloud Platform is coming off a year where it built out its strategy, sales team, and differentiating services, but also had performance hiccups. However, Google Cloud is getting a lift via COVID-19 and Google Meet and setting up a strategy to manage multi-cloud workloads. In 2021, you can expect Google Cloud to continue to expand its footprint with new regions and data centers.

Must read:

With an annual revenue run rate approaching $16 billion, Google Cloud Platform has been winning larger deals, has a strong leader with Oracle veteran Thomas Kurian, and is seen as a solid counterweight to AWS and Microsoft Azure. Kurian appears to be building out an Oracle-ish model where it targets industries and use cases where it can win. Think retail, where customers leverage Google ads, as well as cloud compute without worries about Amazon. Think education. Think finance.

Must read:

Google CEO Sundar Pichai said COVID-19 was an inflection point for digital shifts. “Ultimately, we’ll see a long-term acceleration of movement from businesses to digital services, including increased online work, education, medicine, shopping, and entertainment. These changes will be significant and lasting,” he said.

Must read:

Meanwhile, Google Cloud Platform has been building out partnerships with key enterprise players such as Salesforce, Informatica, VMware, and SAP. The company is also combining its G Suite and Google Cloud sales efforts.

The Google Cloud Platform strategy requires a team that can sell vertically and competes with the sales know-how from AWS and Microsoft. Kurian has surrounded himself with enterprise software veterans. (See: Former Microsoft exec Javier Soltero to lead the Google G Suite team)

A recent hire is Hamidou Dia as Google Cloud’s vice president of solutions engineering. Hamidou was most recently Oracle’s chief of sales consulting, consulting, enterprise architecture, and customer success. Google Cloud also named John Jester vice president of customer experience. Jester will lead a services team focused on architecture and best practices. Jester was most recently corporate vice president of worldwide customer success at Microsoft.

Also: What makes Google Cloud Platform unique compared to Azure and Amazon

The primary cloud option in China

Alibaba has scaled rapidly with a bevy of enterprise partners. What remains to be seen is whether Alibaba can expand beyond China. In either case, Alibaba has a lot of runway ahead.

If your company has operations in China and is looking to go cloud, Alibaba is likely to be a key option.

Alibaba’s cloud annual revenue run rate is nearly $10 billion exiting its most recent quarter. Perhaps the most notable disclosure was that 59% of the companies listed in China are Alibaba Cloud customers. Meanwhile, Alibaba is building out its next-gen cloud as well as capacity in China, EMEA, and elsewhere.

While Alibaba Cloud flies under the radar for customers that are primarily focused on the EU and US, companies operating in China may use it as a preferred cloud vendor. To that end, Alibaba Cloud is forging alliances with key enterprise vendors and is seen as a leading cloud service provider in Asia.

Must read:

The catch with Alibaba Cloud is that US-based customers are likely to run into politics, data concerns, and trade wars, but it’s quite possible that Alibaba Cloud can jump the rankings based on revenue just because the Chinese cloud market will be massive.

Hybrid/multi-cloud

With the battle between the hyperscale cloud vendors underway, you’d think that the legacy infrastructure players would recede to the background. Instead, the likes of IBM, Dell Technologies, and HPE aim to become the glue between multicloud deployments that feature a blend of private and public clouds as well as owned data centers. After all, most enterprises are looking at a multicloud strategy.

The two multicloud enablers in this mix are open source pioneer Red Hat, owned by IBM, and VMware, which is owned by Dell Technologies. Toss in Hewlett-Packard Enterprise, Lenovo, and Cisco Systems for solving select issues and you have a vibrant hybrid and multi-cloud space to consider. Here’s a look at the key players that aim to be the point guards of the public cloud and how they’ll connect to the hyperscale providers.

IBM outlined the rationale for the $34 billion Red Hat purchase and its strategy for turbo-charging its growth in the future.

In 2020, IBM doubled down on Red Hat and is spinning of its managed services unit in 2021. Here’s the setup for IBM going into 2021:

CEO Arvind Krishna has said IBM’s big bets revolve around hybrid cloud, automation and AI. He has also said that the spin-off of the managed infrastructure unit will give IBM more focus.

Krishna North Star for IBM goes like this:

I want IBM-ers to lead with a more technical approach. I want our teams to showcase the value of our solutions as early as possible. Likewise, there must be a relentless focus on quality. Our products must speak for themselves in terms of user experience, design and ease of use. My approach is straightforward: I am going to focus on growing the value of the company. This includes better aligning our portfolio around hybrid cloud and AI to meet the evolving needs of the market.

One key item to watch is how IBM blends its cloud and hybrid approach with emerging technologies. Consider:

VMware has an incumbent position, key partnership with AWS, and a parent in Dell Technologies that is using the cloud management platform to power its own platform. VMware has a knack for evolving as the cloud ecosystem shifts. For instance, VMware was focused primarily on virtualization and has fully adopted containers. VMware powers legacy enterprise data centers, but has extended to being the connector to public cloud providers after being a leader in private cloud deployments. In addition to its lucrative AWS partnership, VMware also has partnerships with Microsoft Azure and Google Cloud Platform. And for good measure, VMware has integrated system partnerships with multiple hardware vendors.

But VMware also needs to name a new CEO given Pat Gelsinger is now running Intel.

The company’s VMworld 2020 virtual conference also highlighted how the company is eyeing AI workloads via partnerships with Nvidia as well as architectures such as Project Monterey to scale them.

Recent headlines give a flavor for VMware’s evolution and where it fits into the enterprise mix:

So, where does Dell Technologies fit? Like IBM and Red Hat, Dell Technologies is looking to VMware as the software glue to give it a cloud platform that can span internal and public resources. VMware is the linchpin to the Dell Technologies’ cloud effort.

Dell Technologies’ long-game for the hybrid cloud revolves around a leadership position in integrated and converged systems, a vast footprint in servers, networking, and storage, and VMware’s ability to bridge clouds. Dell Technologies is also aiming to deliver everything as a service.

At Dell Technologies World conference in Las Vegas, the company outlined a hybrid cloud strategy that aims to knit its data center and hybrid cloud technologies with public cloud providers such as Amazon Web Services and IBM Cloud with more to come. The effort is dubbed the Dell Technologies Cloud. VMware is also launching VMware Cloud on Dell EMC, which will include vSphere, vSAN, and NSX running on Dell EMC’s infrastructure.

In addition, Dell Technologies is launching a data-center-as-a-service effort where it manages infrastructure in a model that lines up with cloud computing one-year and three-year deals. VMware Cloud on Dell EMC is also designed for companies running their own data centers, but want a cloud operating model. Dell Technologies data center as a service effort is built on a VMWare concept highlighted last year called Project Dimension.

Enterprises are likely to be either in the Red Hat or the VMware camp, and both companies have big parents that have the scale into private clouds and hybrid data centers.

Hewlett Packard Enterprise’s hybrid cloud strategy revolves around its stack of hardware — servers, edge compute devices via Aruba, storage and networking gear — and its various software platforms such as Greenlake, SimpliVity, and Synergy. HPE prefers the term “hybrid IT” over multicloud, but its approach rhymes with what IBM and Dell Technologies are trying to do. The catch is that HPE doesn’t have the scale that Red Hat and VMware have.

Nevertheless, HPE has key partnerships with Red Hat, VMware, and integrated and converged systems with cloud providers. HPE’s stated goal is to offer its entire portfolio as a service over time. HPE CEO Antonio Neri outlined the strategy in an interview with ZDNet. Neri said:

We want to be known as the edge-to-cloud platform as-a-service company. And in that there are three major components. One is, as-a- service because obviously customers want to consume their solutions in a more consumption driven, pay only for what you consume. And that experience, at the core is simplicity and automation for all the apps and data, wherever they live.

Obviously, the edge is the next frontier. And we said two years ago that the enterprise of the future will be edge-centric, cloud-enabled and data-driven. Well, guess what? The future is here now. The edge is where we live and work.

Must read:

Where HPE’s approach to hybrid deployments is differentiated is in its Aruba unit, which provides edge computing platforms. HPE aims to extend its cloud platform to edge networks. That cloud-to-edge approach could pay off in the future, but edge computing is still a developing market. In the meantime, HPE is tapping into Azure for management talent.

HPE

Keith White, a former Microsoft executive, will lead HPE’s Greenlake business, which aims to help transform the company into an as-a-service juggernaut.

HPE is also looking to address container management and sprawl with its BlueData software.

Cisco Systems has a bevy of multi-cloud products and applications, but the headliner is ACI, short for an architecture called Application Centric Infrastructure. Cisco is also melding AppDynamics, cloud management, and DevOps.

Those parts are adding up to Cisco pursuing an everything-as-a-service model starting with an effort called Cisco Plus.

Not surprisingly, Cisco’s approach to multi-cloud is network-centric and ACI focuses on policy, management, and operations for applications deployed across cloud environments.

Cisco has partnerships with Azure and AWS and has expanded a relationship with Google Cloud. Add in AppDynamics, which specializes in application and container management, and Cisco has the various parts to address hybrid and multi-cloud deployments. In addition, Cisco is a key hyper-converged infrastructure player and its servers and networking gear are staples in data centers.

Must read:

Software as a Service

Software as a service is expected to be the largest revenue slice of the cloud pie. According to Gartner, SaaS revenue in 2020 is expected to be $166 billion compared to $61.3 billion for IaaS.

For large enterprises, there are a few realities. For starters, you’re likely to have Salesforce in your company. You’ll probably have Oracle and SAP, too. And then there may be a dose of Workday as well as Adobe. We’ll focus on those five big vendors and their prospects. It’s also worth noting that some of the previous vendors mentioned are primarily SaaS vendors. Microsoft Dynamics and Office are two software products likely to be delivered as a service. Your roster of software providers is as diverse as ever.

Here’s a look at the leading cloud software vendors.

Salesforce’s ambitions are pretty clear. The company wants to enable its customers to utilize its data to provide personal experiences, sell you its portfolio of clouds, and put its Salesforce Customer 360 effort in the center of the tech world. In 2020, Salesforce expanded its reach with Work.com, a suite to enable workers to head back to the office during the COVID-19 pandemic.

Vaccine management is also a hot area for Salesforce. Salesforce said that its vaccine management tools are used by more than 150 government agencies and healthcare organizations. Salesforce’s Vaccine Cloud is being used to build and manage COVID-19 vaccine efforts and track outbreaks.

Recent developments highlight Salesforce’s approach to invest through a downturn. Salesforce also said it will acquire Slack to connect its various clouds. The company outlined its 2021 ambitions at its Dreamforce conference:

Salesforce executives have outlined the road to doubling revenue in fiscal 2025. Indeed, Salesforce has acquired or built out what could be an entire enterprise stack as it pertains to customer data. Its acquisition of Tableau may also be transformative since the analytics company has a broader footprint and gives Salesforce another way to reach the broader market.

Also: Salesforce launches Salesforce Anywhere, app that embeds collaboration, data across platforms

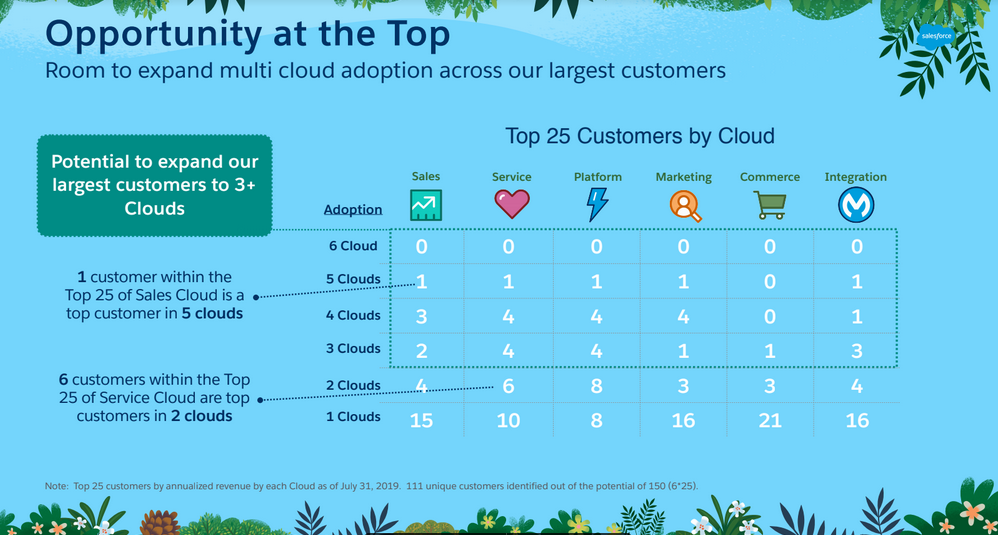

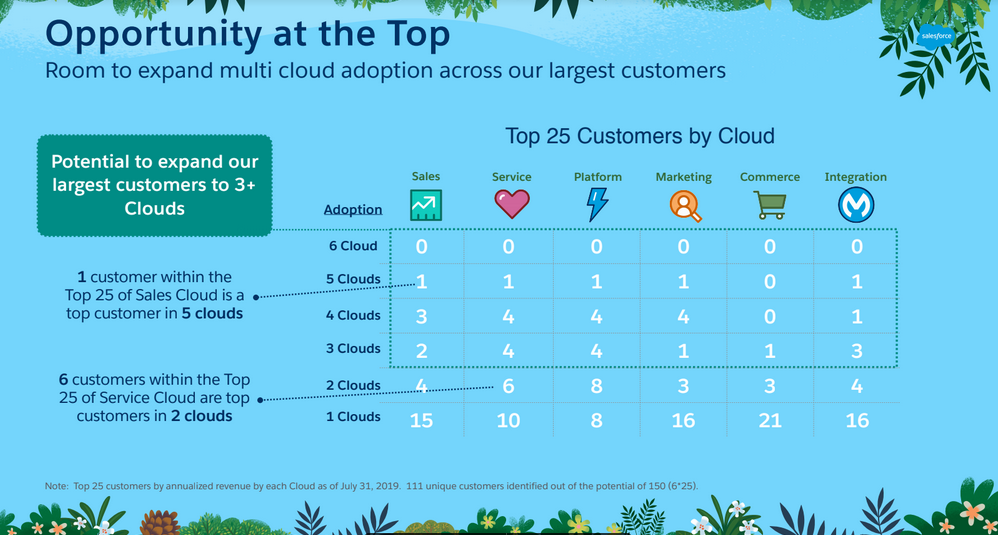

What remains to be seen is whether Salesforce’s Customer 360 platform can bring all of its clouds together in a way that prods enterprises to buy the entire portfolio in a SaaS buffet. At its analyst meeting, Salesforce noted that it had one customer in its top 25 with five clouds from the company, no customer with six, and a handful with three or four clouds. Slack will also bring more customers and reach to Salesforce.

Salesforce will need its top customers to adopt more clouds if the company is going to get to its $35 billion revenue target in fiscal 2025.

Salesforce’s current lineup consists of clouds for integration, commerce, analytics, marketing, service platform, and sales. Service and sales clouds are the most mature, but others are growing quickly. Salesforce’s Einstein is an example of AI functionality that’s an upsell to its clouds. In the end, Salesforce sees a $168 billion total addressable market. Work.com could add more to that tally.

Must read:

Oracle does infrastructure. Oracle does platform. Oracle does database, which is increasingly autonomous. Despite its IaaS and PaaS footprint, Oracle is mostly a software provider when it comes to cloud. With the addition of NetSuite, the company can cover small, mid-sized, and large enterprises.

While Oracle came into 2020 as an afterthought in IaaS, it has had an eventful second half of the year. Oracle landed Zoom as a reference customer for its cloud and is seeing momentum into 2021.

Must read:

Edward Screven, Oracle’s chief corporate architect, said in an interview that the company is expanding its hyperscale reach for IaaS and plans to hit 36 facilities by the end of the year. While SaaS is core, Oracle is also landing new users with infrastructure and a free tier. “A lot of conversations we have are about SaaS, but enterprises need to build SaaS using the tools we have so they look at the platform. And everyone is looking for a fast, reliable and cost-effective compute,” said Screven.

In other words, IaaS players start with compute and storage and move up the stack. Oracle can start at the high end and work back into infrastructure. “AWS was first, but we have a lot of customers with experience already with Oracle Cloud,” he said. Screven said that Oracle Cloud is seeing more developer interest due to a free tier.

The big win for Oracle’s cloud business will be SaaS and autonomous database services. Oracle’s cloud is optimized for its own stack, and that will appeal to its customer base. Oracle’s Cloud at Customer product line is also appealing to hybrid cloud customers. Oracle will put an optimized autonomous database in an enterprise and manage it as if it was its own cloud.

Will Oracle go multi-cloud and partner with frenemies? Yes and no. Microsoft Azure and Oracle are partnered to combine data centers and swap data with speedy network connections. Oracle isn’t likely to partner with Google Cloud given its court battles with the company. Oracle isn’t likely to cozy up to AWS either.

For enterprises, Oracle’s cloud efforts will be powered by SaaS and it will be a player in other areas. It’s unclear whether Oracle’s bet on what it calls Generation 2 Cloud Infrastructure will pay off, but its enterprise resource planning, human capital management, supply chain, sales and service, marketing, and NetSuite clouds will keep it a contender.

SAP CEO Christian Klein is looking to keep its cloud momentum, expand HANA and Qualtrics and battle Salesforce, Oracle, and Workday. Klein is also looking to focus SAP and simplify. He’s also looking to shift SAP’s customer base to the cloud on an accelerated timetable.

Klein said:

Instead of doing everything ourselves, we are co-innovating. We have always been the leading on-premise application platform. Thousands of partners and customers have built applications and extensions on SAP for almost 50 years. Our intention is to repeat that for the cloud to position SAP as the leading cloud platform to transform and change the way enterprises work in the digital age. To get there, we have put a lot of work into our cloud platform over the past 12 months, and we will continue to invest in innovation. The time when SAP developed and engaged with customers in silos are over.

SAP’s 2021 plan is to migrate its customers to the cloud faster and create one data model. Klein added:

We will bring the full force of our business applications and platform to drive holistic business transformation. By enabling our customers to seamlessly design, evolve or in win new business models with agility and speed. To do so, all our main solutions will adopt the cloud platform and share one semantical data model, one AI and analytics layer, one common security and authorization model and the same application business services such as workflow management, with our cloud platform, powered by SAP HANA. Process can be changed, enabling agile workflows. Innovations and extensions can be developed quickly by customers and partners accessing our open platform, using exactly the same data model in business services as our own SAP app. We are convinced that the real value driver of intelligent enterprises in the cloud will be the ability to adapt and on new business model holistically end-to-end with one consistent data model.

Must read:

Workday has more than 3,000 customers and the human capital management software vendor is increasingly adding financial management customers too. As a result, Workday is among the cloud vendors gaining wallet share, according to a Flexera report.

The company is at an inflection point where it is selling more clouds and has a big market to chase as it courts mid-market companies. While the SaaS menu at Workday is decidedly more limited than what rivals SAP and Oracle offer, the company enjoys tighter focus.

Workday co-CEO Aneel Bhusri said that his company is entering an expansion phase that rhymes with the Salesforce playbook. Workday ultimately sees its financial platform being the equal of its HR footprint. Planning and procurement are other new areas. Ultimately, Workday’s SaaS challenge will be to sell multiple clouds to customers.

Bhusri said:

“I would point you to the transition that Salesforce went through. They’re 6 years older than us, one of our best partners. They went from being a sales company to a sales and services company to a sales and service and marketing company and platform. Now they’ve got analytics. We’re going through that same journey and growth rates kind of ebb and flow as the different pillars take off.”

Workday is infusing machine learning and automation throughout its platform.

Adobe has been a well-established cloud vendor among content creators and marketers, but a plan to focus on digital experiences and data management will put it on a collision course with the likes of Salesforce, Oracle, and SAP in areas like marketing. So far, so good.

The company continually expands its addressable market.

For enterprises, Adobe’s plan to dramatically expand its total addressable market can be a good thing — especially if the company can be used as leverage against incumbent providers.

The company is also looking to be a key part of your data and digital transformation strategies. Adobe has hired former Informatica CEO Anil Chakravarthy as head of its digital experience unit. The move highlights how Adobe sees data integration as key to its expansion. “Every single business is going through the same digital transformation that we were lucky enough to go through almost a decade ago. And if a company cannot engage digitally with the customer, understand how the funnel, all the way from acquiring customers to renewing them, can be done digitally, they’re going to be disadvantaged,” said Adobe CEO Shantanu Narayen.

ServiceNow had a strong 2020 and emerged as a SaaS provider delivering growth and becoming a platform of platform for various workflows.

Although ServiceNow is best known for its IT service management platform, it has expanded into a bevy of other corporate functions. In addition, CEO Bill McDermott has aimed the ServiceNow platform at industry specific use cases, including vaccine management as it evolves. McDermott said:

Here are a few trends shaping the overarching environment for ServiceNow. This unprecedented environment is breaking physical supply chains. It is exposing the weak links in the old value chains, illuminating how companies struggle cross-functionally to deliver the workflows that create great experiences for customers, employees and partners. The world is experiencing a seismic shift from the obsolete business process evolution to the new workflow revolution.

Must read:

The game plan for ServiceNow is to be a digital transformation engine by connecting systems of records to be a system of action.

One key example is how ServiceNow has aimed its platform at back-to-work management efforts. Among the key 2020 developments for ServiceNow:

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.