TSMC continues to dominate the global foundry business with Samsung a distant second

TSMC keeps its large lead in global market share over Samsung Foundry

Trend Force notes that while Samsung Foundry is showing strong revenue growth, the bottom line has not been able to stay in gear as “the slower ramp-up of advanced process capacity continues to erode overall profitability.”

TSMC’s results for the quarter were bolstered by strong growth in revenue connected to the production of 5nm chipsets for the iPhone 13 series. The only TSMC process node that showed a drop in the top line for the fourth quarter was the 7nm/6nm unit which was impacted by a weak smartphone market in China. Samsung’s strong 15.3% hike in sequential revenue came about from the completion of its 5nm/4nm advanced process node capacity.

What holds back SMIC is its inability to compete at the current cutting-edge process nodes of 5nm/4nm with both TSMC and Samsung knocking at the door of 3nm. Like the U.S., China is desperately looking to become self-sufficient in semiconductors, and its failure to do so worries experts who fear that China could use TSMC’s success as a reason to take over Taiwan and capture control of the world’s largest contract foundry.

For every $100 in revenue collected by TSMC, $26 of that total comes from Apple

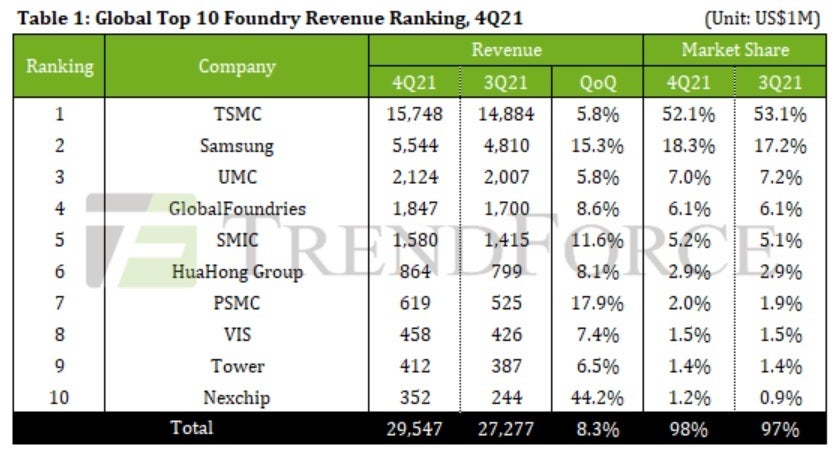

The industry is far from balanced in terms of revenue with the top five foundries controlling 90% of global foundry market share. That is understandable though when you consider that TSMC and Samsung are the leaders in advanced process nodes.

The remaining foundries making up 6-10 on the list and their Q4 market shares include HuaHong Group (2.9%), PSMC (2%), VIS (1.5%), Tower (1.4%), and Nexchip (1.2%). The latter might have reported the lowest market share of global foundry revenue for Q4, but it did show the largest growth rate in revenue quarter-over-quarter at 44.2%.

For the fourth quarter, global foundry revenue came in at $29.55 billion, up 8.3% from the third quarter.

For all the latest Technology News Click Here

For the latest news and updates, follow us on Google News.